- Project: Full-stack platform for tokenized business-backed portfolios

- Technologies: React, Tailwind, Node.js, Solidity, Ethereum-compatible chains

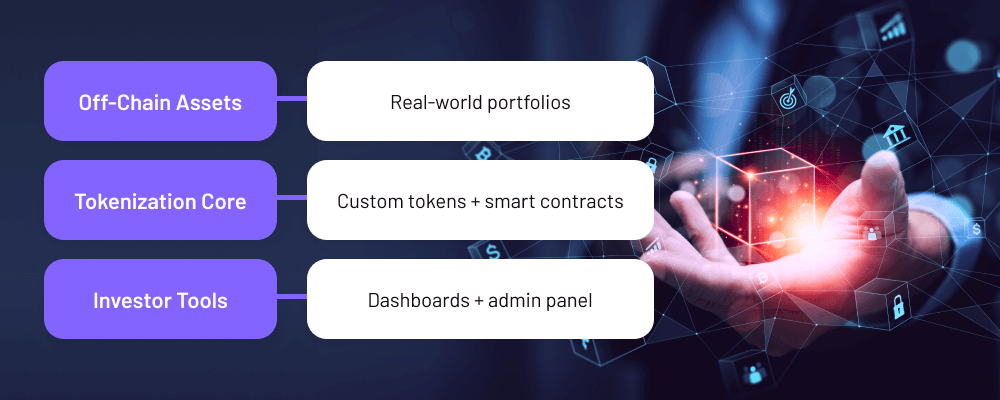

The client is a private investment firm seeking to digitize and scale capital participation in off-chain business-backed portfolios.

The Client’s Request

The client initiated a blockchain-powered investment platform development to gain the possibility to convert off-chain, revenue-generating portfolios into on-chain investment products. Key priorities included a flexible infrastructure, a robust token model, investor transparency, and a future-proof architecture.

They envisioned a system with dual-token logic: one utility token and another linked to specific pools, supporting various investor flows such as staking, vesting, and buybacks. A smooth and informative investor experience was essential, requiring real-time dashboards with portfolio metrics, event logs, and yield indicators.

Just as critically, the platform needed to be modular, scalable, and governance-ready, so it could be reused across different asset types in the future.

With a history of delivering compliant, blockchain-based and fintech platforms, Velvetech was selected for its ability to combine custom smart contract development with user-friendly UI/UX and institutional-grade architecture.

The Process

We built an MVP of white-label platform that gave the client full control over investment mechanics, user access, and smart contract configuration.

Find out Why MVP Apps Fail and How to Build a Killer One

At its foundation is a custom dual-token model, combining a primary utility token with pool-specific ones that represent participation in various business-backed investment products. This setup enables investors to access portfolios with clearly structured entry conditions, vesting timelines, and automated buyback rules.

We also implemented DAO-compatible governance logic and a secure admin system with multisig controls. On the front end, we created intuitive dashboards for both investors and administrators: investors can monitor performance, rewards, and asset history, while admins manage pool status, portfolio uploads, and investor engagement flows.

The platform also features built-in incentive layers, including staking mechanics, token burn triggers, and utility-based reward models, all designed to foster long-term investor participation.

Check out how we delivered a Tokenized Investment Platform for Real-World Assets

Results

Velvetech delivered a production-ready MVP that successfully simulates real-world investment flows and supports institutional-grade deployment. The modular architecture ensures the platform can be reused across multiple portfolio types with minimal customizations.

At the moment, the platform includes upgradeable smart contracts, DAO-compatible governance, and audit-ready infrastructure — all fully prepared for launch.

Our specialist will contact you to schedule a personalized consultation within one business day.

Velvetech offers complimentary consultations; after which, we will provide you with a proof of concept in just 3 days, an accurate outlook of the cost and timeline of your project and a competitive estimation, and an assembled team – ready to start your project within 7 days.

Proof of Concept in

Start Project within