- Project: Development of the FPGA-based platform to support high-frequency trading

- Duration: 10 months

- Technologies: Verilog, SystemVerilog, Intel HLS, C/C++, GoLang, MongoDB, Kubernetes, React, GraphQL

- Target audience: Traders

Our Client is a FORTUNE 500 company providing communication and cable services and offering various tech solutions to ensure broadband connectivity. In pursuit of expansion into the new market, the company evolves and harnesses advanced technologies to come up with new solutions for ultra-HFT.

THE CASE

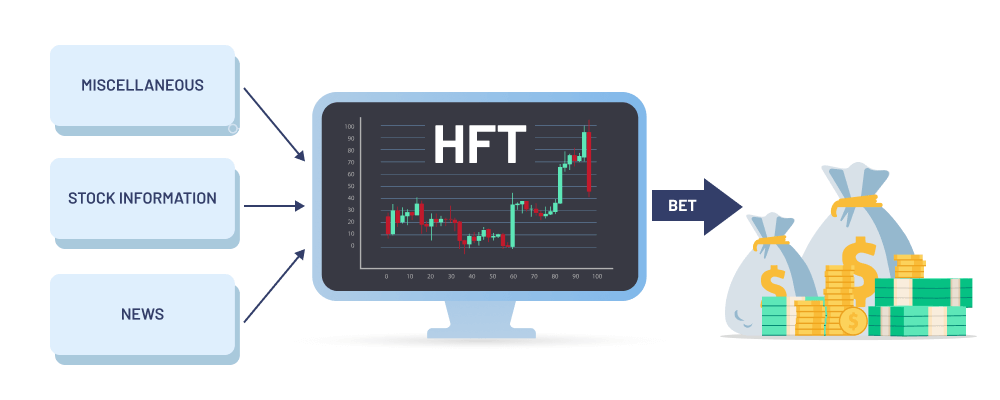

The company approached Velvetech with a project idea to create an innovative product that would take trading experience and connectivity in this field to the utmost level. They wanted to build a Proof of Concept so that professional traders and quantitative analysts could design algorithms for HFT, or high-frequency trading, in an easy way, ensuring the latency of nanoseconds without the need to engage FPGA developers.

Challenge

In the world of trading, the speed of connection plays a crucial role. That’s why every company desiring to build a system for making profits considers leveraging ultra-HFT. In the end, time is money, and the one who executes trades in fractions of a second takes it all.

The truth is that ultra-HFT platforms allow for the lowest tick-to-trade latency — an interval taken to respond to incoming market data and process buy and sell orders. Such speed of nanoseconds or even picoseconds can ensure significant profits, making the development of these systems a lucrative niche with great competition on the market.

However, it wouldn’t be possible to achieve such fast computing without the use of FPGA-based hardware acceleration. Unlike any other digital circuits, these field-programmable gate arrays can be reconfigured to perform a wide range of tasks, which makes them a perfect fit for the high-speed processing of large amounts of data required by HFT.

Learn more about the Role of FPGA in High-Frequency Trading

Ultimately, FPGAs greatly scale hardware computing performance and can process a multitude of tasks simultaneously. Such an excellent combination of efficiency, speed, and flexibility is ideal for empowering HFT systems.

That’s why it was an unquestionable decision to use this technology for the development of the Client’s HFT software. However, it’s not an easy endeavor to design FPGA-based solutions as it requires great effort, very specialized skill sets, and experience in certain programming languages like VHDL or Verilog.

Our team has deep expertise in hardware engineering, FPGA development, and delivering complex fintech projects. Mixed with vast knowledge of trading software development, it has allowed Velvetech to undertake this challenge and jump on a project that promised to be a real piece of art.

Process

To deliver tangible results for the Client, we’ve assembled a team with relevant skills and experience. The roles to support the project implementation included the following:

- Project Manager

- Business Analyst

- 3 FPGA Engineers

- Backend Developer

- Frontend Developer

The process contained various phases and tasks, but in essence, it could be split up into four major stages that we’ll describe below.

Analysis and Prototyping

The first and most fundamental stage encompassed analysis, technical design, and prototyping as well as user interface prototyping. While working on this part, our team thoroughly considered project requirements, developed an architecture and database model, and set up a test infrastructure that included a server with an FPGA card.

Learn more about Project Requirements in Software Engineering

Velvetech has also elaborated the general logic of the trading algorithm that was divided into several components, such as market data filter and order conditions. During the following project stages, that logic was to be transferred to FPGA hardware fully.

UI and Backend Development

In order to deliver the functionality that the Client requested, it was necessary to implement both the frontend architecture and backend part of the system. The web-based UI relied on React technology and included various drag-and-drop building blocks that ensured the ability for users to easily configure the algorithm and manage the orders. It was designed to be simple, sleek, and intuitive.

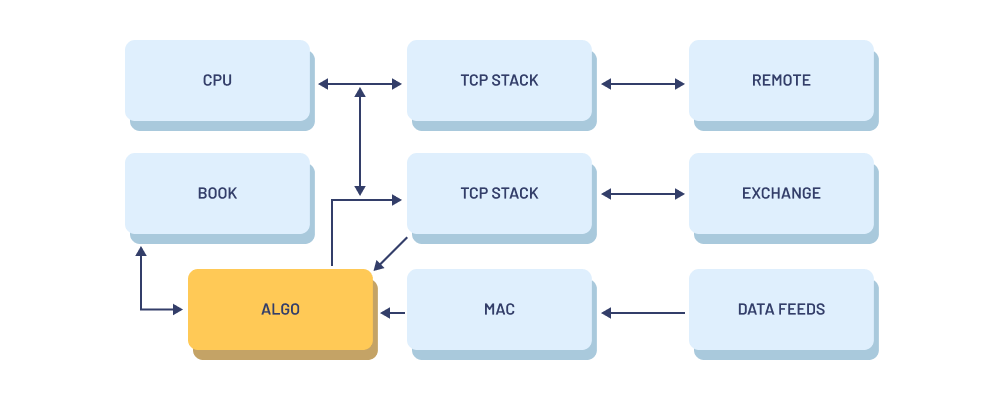

On the other hand, backend development rested on GoLang and provided a set of tools for algorithm management. It was also responsible for the connection to the exchange over the FPGA bridge. An essential component of the backend infrastructure was the API gateway which is like a gluing mechanism ensuring interaction with the frontend.

FPGA Hardware Engineering

Basically, the core of FPGA hardware engineering is an array of programmable blocks and interconnects that wire these blocks together. At this stage, we’ve designed an architecture for an FPGA chip to support desired service functions and establish and maintain a connection with exchanges with minimized latency.

Some portions of the logic were designed using Intel HLS to save time and development effort that would be much higher if everything was done in Verilog.

Given the Client’s request, our team has built a system that allows for different trading activities. They include but are not limited to parsing various data and filtering it, providing pre-trade volume and price checks, executing orders, and monitoring value and loss scenarios to manage risks.

Simulator Development

To demonstrate the delivered functionality and launch test software services and scripts, our team has provided the Client with the FPGA trading demo. As this part required mirroring the real environment, we successfully implemented a test simulator.

In particular, we deployed hardware and software server components, an FPGA card, a border router, and VPN that ensures connection with the exchange. All this allowed the Client to test the PoC — design a trading strategy with building blocks and execute it. The platform can receive market data and perform filtering, display prices, buy and sell market orders, and receive fills.

Outcome

The result of this collaboration is a PoC ready to be rolled out and launched on the client’s side in the test lab designed by Velvetech. Once that is done, the team is planning to move to the MVP phase and then develop a fully-functional product that will work with complex algorithms viable in real-life circumstances.

In general, the solution provides the Client with such advantages:

- Security compliance

- Cheaper maintenance of computer resources

- Higher profits

The company acquired an ultra-HFT platform that further can be used to implement real-world trading scenarios and execute them within nanoseconds. For example, a trading analyst will be able to leverage the platform’s UI to easily build efficient algorithms and run them on stock exchanges to automate order executing and reporting fills.

What’s Next

As we’ve briefly mentioned above, the next step will be working on a fully-fledged HFT platform ready to be launched in the trading exchange environment. Our team keeps testing and reinforcing the solution and algorithms to provide maximum accuracy and minimum latency.

Our specialist will contact you to schedule a personalized consultation within one business day.

Velvetech offers complimentary consultations; after which, we will provide you with a proof of concept in just 3 days, an accurate outlook of the cost and timeline of your project and a competitive estimation, and an assembled team – ready to start your project within 7 days.

Proof of Concept in

Start Project within