- Project: The development of a SaaS platform made of web and mobile apps to manage alternative investments

- Duration: 16 months

- Technologies: TypeScript, Next.js, AWS Cloud, PostgreSQL Server, Apache Kafka

- Target audience: Accredited investors, MCA funding companies, merchants seeking capital

Supervest bridges the gap between accredited investors, MCA funding companies, and merchants in need of capital by providing an easy-to-use, secure, and transparent platform for alternative investment management.

THE CASE

At the time of approaching Velvetech, Supervest had already developed an investment management tool that functioned as a module of a bigger platform. However, being part of an already large system hindered Supervest’s growth ability. For this reason, the company was looking to transition its investment module into a separate, fully-functioning SaaS solution.

The Client’s Request

Making any database changes to the Supervest module required adapting the entire existing system since the two had a unified architecture which was written over 5 years ago on PHP. As the user base was expanding, the company wanted to incorporate new features, improve the UI/UX, and ensure that system performance could be maintained at a proper level.

Hence, the Client was seeking a financial software development partner to help build a web-based SaaS platform as a separate and scalable solution for Supervest. All with the goal of efficiently catering to the needs of those involved in MCA investments.

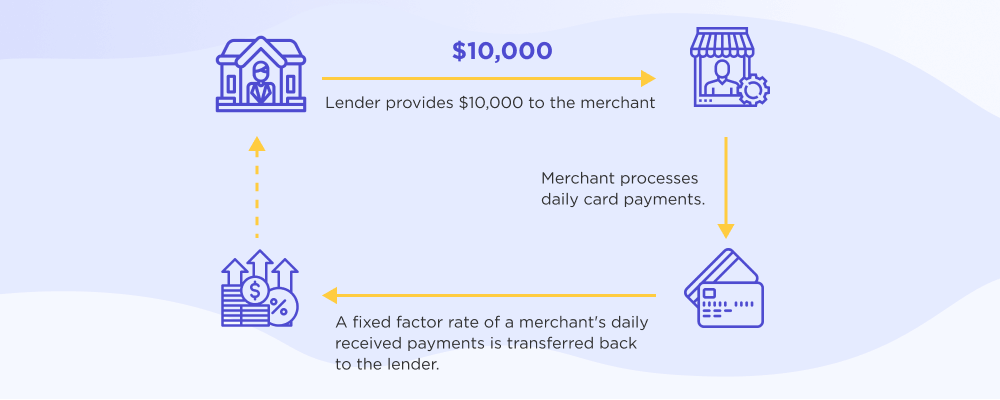

Merchant Cash Advance as an Alternative Investment Form

A merchant cash advance is an alternative investment option best suited for small businesses or startups that require a large sum of money quickly but may be unable to secure traditional loans from banks. In short, it is a lump sum of money that the lender provides in exchange for a percentage of future sales or a fixed, regular remittance.

Contrary to bank loans, merchant cash advances are typically characterized by short payment terms and small regular payments. These loans are unsecured, thus not requiring businesses to hold any assets to get funded. As a result, applications for MCAs can be approved within 24 hours.

It’s important to note that MCAs are only suitable for businesses that process card payments. This is because lenders determine whether they wish to invest based on the card turnover of an organization. As such, online retailers are some of the primary users of MCAs.

Process

Our expertise in custom software development and the financial sector helped the team stand out and be selected as the IT partner for the project. On top of that, Velvetech has been helping clients design efficient SaaS solutions for years, which became another valuable factor for Supervest to engage our team.

Initially, the Client only wanted to migrate the existing investment management module to a standalone platform.

However, as the collaboration with Velvetech continued, the scope of work expanded. Thus, our team performed the following tasks for the new alternative investment management platform development:

- Building a web part of a system

- Migrating data onto the new platform

- Implementating brand new features

- Investor mobile app development

Development of a SaaS Investment Platform

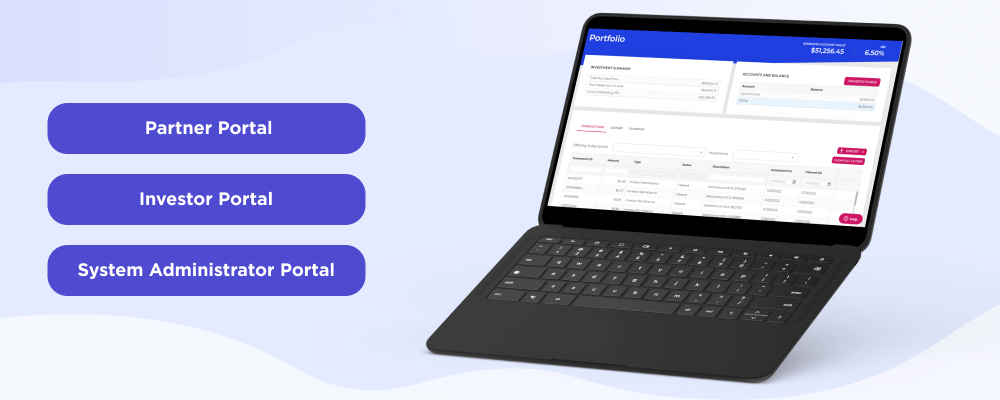

In order to develop a truly all-encompassing MCA investment management software, the system had to possess three interconnected portals, one for each group of users — partners, investors, and system administrators. Since all three areas have to work together, Velvetech’s specialists decided to build them in parallel with each other.

Partner Portal

Partners are essentially intermediaries between merchants seeking capital and investors. Thus, they are the ones who make new investment requests on behalf of their merchant pool. For this reason, the Supervest platform had to have a partner portal that would be intuitive and simple to use.

In this case, the main requirement was to allow investors to easily input all merchant-related investment data into the platform so that it could be processed quickly.

Investor Portal

The investor-facing side of the platform had to stand out from other investment portfolio management tools on the market. To ensure this, we developed two offerings for an investor to choose from — MCA Self-Directed and the 12% Note.

The MCA Self-Directed option was built for advanced investors who wanted to retain control, pick investment criteria themselves, and carry the risks on their own shoulders. For this group of users, our team developed the process of automatic investor-opportunity matching.

Specifically, the team automated the matching process based on the criteria each investor had set. On the new system, after registration, investors were provided a form where they could set their investment criteria. For example, they could specify:

- The amount of capital they were willing to invest into a single opportunity

- Their preferred industries

- The years the company has been on the market

- Maximum investment limit per month

- FICO range

- Lien position

- Term months

So, whenever a partner added new investment requests, the system could automatically match them to the most suitable investor based on the risk profile they had set. Thus, simplifying and significantly speeding up the process.

Thanks to the automatic matching, it would now only take half an hour from the moment a new investment opportunity was created until a suitable investor was found and capital could be allocated. Then, within 24 hours, the money could be extracted from the Supervest platform and transferred to the merchant in need.

The investors, on the other hand, could now rest easy, look over their investments and get the returns based on how each merchant specified they would pay back. Typically, via a percentage of sales.

Conversely, with the 12% Note, investors with less experience and higher risk aversion could still capitalize on the capabilities of Supervest. In this case, users can simply transfer a minimal deposit for a specified duration and get a guaranteed 12% of annual returns with quarterly payouts. Thus, requiring no monitoring from the user.

The 12% Note offering is owned by Supervest and it is the administrator who sets that criteria for investments. Thus, money is pooled from a collection of investors and then distributed among the various opportunities that are deemed appropriate based on Supervest-selected criteria.

Another unique feature of the investor portal was that Velvetech’s team ensured it was fully integrated with the bank. Usually, in these kinds of systems, a payment gateway or some sort of intermediary like Stripe has to be implemented to process payments on behalf of the organization.

Read about Payment Gateways Integrations in Mobile Apps

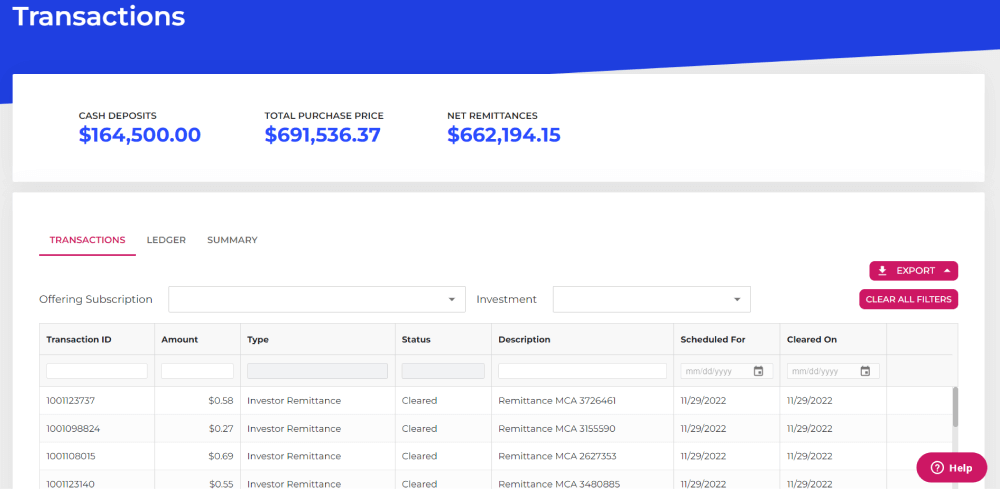

Instead, our team utilized the FTP protocol to ensure data could be exchanged with the bank directly. This way, transaction information is sent to the bank as a NACHA file and the system can communicate with the financial institution swiftly. Thus, allowing the investor to have a comprehensive overview of all the transactions and easily monitor every occurrence.

System Administrator Portal

Lastly, the system administrator side of the platform was also developed for Supervest personnel. Here, it required the ability to access key information across the software so that any issues could be fixed swiftly.

Concretely, it provided the following capabilities:

- Access to all investments with the option to edit and update them, review participating investors and adjust the amounts they’ve invested.

- Access to all transactions within the system, including partner and investor ones, with the ability to filter and search for concrete ones.

- Review of the ledger of any system participant.

- Permission management for administrators.

Mobile App Development

Following web app development, the Client decided they also wanted to round off their SaaS solution and deploy a mobile app version of their investment management platform. The application was needed only for the investors as it would allow them to manage their money on the go.

After enlisting the help of Velvetech’s iOS specialists and Android developers, the mobile app version of Supervest was built and prepared for release. Currently, it is awaiting deployment while the team prioritizes fine-tuning tasks and feedback processing of the web solution.

Discover the Process of Mobile App Development

Challenges

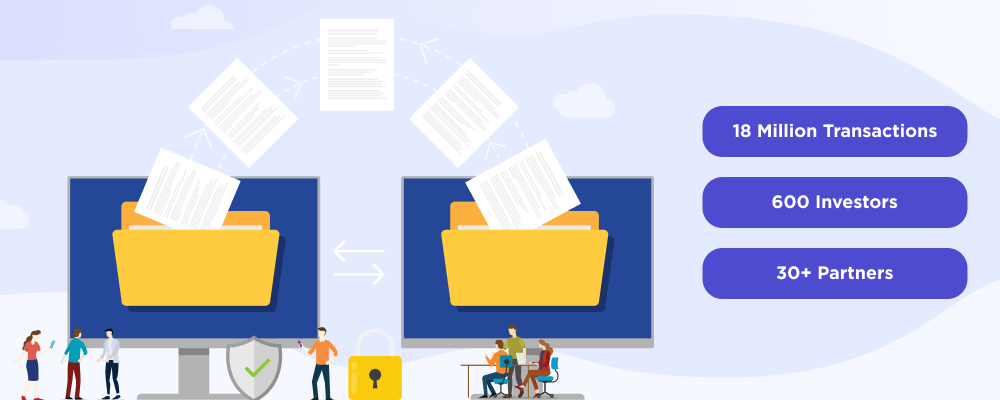

The biggest challenge our team faced when building this software for alternative investment management was data migration. Within the original system, there were 18 million transactions, 600 accredited investors, and more than 30 partners. All of these records had to be transferred onto the new standalone platform without any inaccuracies.

Data management can get tricky and on this project, the main difficulty arose due to the different transaction types between the two systems. As the name suggests, transaction types help classify each individual payment by listing it as a deposit, withdrawal, commission, refund, or the like.

On the new platform, Velvetech’s team created 24 different type options. However, within the old version, some parts of transaction history didn’t have any type listed or were classified in a way that didn’t correspond with the new Supervest. Thus, making it impossible to classify each transaction automatically.

Naturally, this could be a big problem since account balances attributed to investors were under the risk of being inaccurate and misaligned. So, Velvetech’s team had to ensure there were no discrepancies following the migration.

This was done iteratively, by going through investor balances and double checking the numbers. If an issue was discovered, it was fixed manually. By the end of the process, all transactions had been accounted for and when investors entered the platform, there were no misalignments.

Take a look at how we successfully performed Legacy System Migration for a Greenhouse Company

Outcome

As a result of our collaboration, a brand new Supervest SaaS platform was developed to help with investment management for the MCA industry. The system has been launched and is already helping bridge the gap between investors, MCA funding companies, and merchants in need of capital.

What’s Next

Velvetech is happy to continue the collaboration with Supervest by providing support and maintenance as well as the implementation of new features. Currently, it’s been decided that our specialists will keep working on the following aspects:

- Implementing changes based on user feedback from the web app

- Deploying the iOS and Android versions of Supervest for investors

- Maintaining all of the solutions with regular testing and updates

- Developing new features to further differentiate and enhance the platform

Our specialist will contact you to schedule a personalized consultation within one business day.

Velvetech offers complimentary consultations; after which, we will provide you with a proof of concept in just 3 days, an accurate outlook of the cost and timeline of your project and a competitive estimation, and an assembled team – ready to start your project within 7 days.

Proof of Concept in

Start Project within