Blockchain-based insurance solutions have revolutionized the industry, creating a transparent and trustless ecosystem — with startups like Lemonade or 3Bi building insurance products on the distributed ledger technology.

The global blockchain in insurance market is expected to reach $1.32 billion by 2024 at a 69.72% CAGR during 2019-2024. It means that the industry incessantly keeps giving in to the charms of blockchain-powered apps.

How Blockchain Is Used in InsurTech

Driving digital transformation, blockchain solutions majorly help insurance companies enhance process transparency, reduce fraudulent activities, save time, and improve customer service.

The following use cases provide a comprehensive overview of how insurers apply this powerful technology.

Claim Management

Smart contracts can efficiently reduce the load related to paper-heavy operations that claim management is usually associated with.

Supporting the validation of information against other records, blockchain-based ecosystem streamlines and automates claim submission. It results in operational cost reduction while ensuring transaction security.

Another scenario when claim management benefits from blockchain technology is payout processing. If banks and insurance companies work in a unified system relying on a distributed ledger, policyholders win from reduced timing for payouts.

Reinsurance

Blockchain is successfully implemented across the reinsurance and retrocessional value chain. The risks can be ceded with the use of blockchain apps that help process treaties, inform all interested parties, and handle payments.

The technology elevates risk understanding within the sector and leads to cost savings by accelerating insurance placement and providing more efficient compliance checks.

Fraud Detection & Abuse Prevention

It’s highly difficult to spot and prevent fraudulent activities with the application of standard methods. Once blockchain is stepping into the game, it helps IinsurTtech companies eliminate the risks of data breaches.

Secured with cryptographic signatures and advanced permission settings, transactions and other sensitive data have fewer chances to be compromised. Insurers can also use blockchain to define suspicious patterns like multiple processing of the same claim.

Key Benefits of the Blockchain Insurance Applications for the Industry

Automation

Blockchains can speed up operations for insurance businesses, make them transparent and cost-efficient through self-executing smart contracts. This benefit is particularly important for insurance products where payouts are caused by an event such as a flood or hurricane.

Automated claim processing that pulls data from external sources — like real-time data streams from weather servers or IoT — can support preprogrammed claims approval, avoiding fraud and improving the experience for the insured.

This use of blockchain technology paired with IoT may be very useful for managing claims in travel insurance, catastrophe swaps, and weather-dependent coverages.

Distributed Databases

Blockchain technology can help avoid human errors and bring down the costs of verification processes. Since different players in the insurance market may synch and reconcile multiple databases — the whole industry enjoys the benefits of increased efficiency, transparency and fraud protection.

Fraud counter is probably the key advantage of distributed ledgers using blockchains due to their shared nature and the tools like smart contracts for self-regulation in an environment with multiple parties with conflicting interests.

Advanced encryption that comes as a part of any blockchain solution ensures data protection and guarantees confidentiality helping mitigate data privacy and ownership issues.

Provenance of Insured Assets

The initial blockchain, Bitcoin, developed to track the origin and transactions of Bitcoin has brought about another attribute of the blockchain technology that can add value to insurance businesses — provenance. Knowing where any insurable asset originates from and being able to track it is hyper important for the insurance industry.

Everledger is a perfect example of blockchain helping bridge the gap between physical objects — diamonds in this case — and their digital traceable representation on the ledger.

In the same manner, blockchains could track “risk provenance” individually by processing data from wearables and IoT devices. Currently, costly know-your-customer techniques are duplicated across companies, and the insights they can provide are not accessible to individuals. Blockchain time-stamped and recorded portable identities could turn this situation around.

P2P Insurance Platforms

Even without reinventing the fundamentals of insurance, blockchain can stimulate new insurance business models that are more transparent and scalable, such as peer-to-peer (P2P) insurance. The technology’s potential to enable self-regulation of trust among parties that used to rely on a central authority serves this purpose pretty well.

There is a growing number of insurance startups in the market that embrace the self-governing, peer-to-peer network model.

Companies like Friendsurance, Lemonade, Guevara, Besure, and others build their P2P insurance solutions on blockchain to overcome fraud issues and ease up scalability of their platforms.

The distributed ledger technology allows transferring rights to a community with aligned interests to manage insurance functions, such as setting policy rules, making and approving claims, reimbursements. This self-regulating network of peers helps handle overheads and admin costs of running an insurance business.

Risk Transparency

Blockchain can also work great in tandem with other cutting-edge technologies like AI and IoT that enable near-real-time pricing for the insurance solutions in the sharing economy.

Since all data resides on a distributed ledger, owned by neither insurers nor insureds, and can’t be modified without all involved parties taking notice — better risk assessment and mitigation can be achieved.

Innovative Insurance Startups

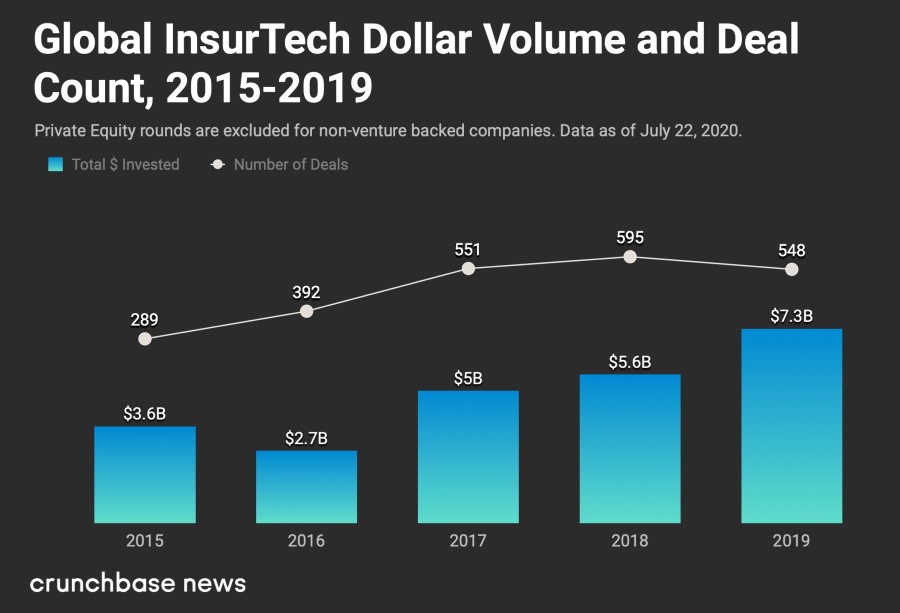

Even if we saw InsurTech funding slowing down a bit in 2020, thanks to startups initiatives there were some remarkable moves in the field. For example, Lemonade raised $319 million with its IPO while its stock surged on the first day of trading.

Below are the companies that lead the pack in applying blockchain technologies.

Source: Crunchbase News

B3i

B3i is a global insurance industry initiative supported by more than 40 companies. Using blockchain and Distributed Ledger Technology (DLT), they develop standards, protocols, and network infrastructures to reduce administrative burden and streamline market-wide processes.

The B3i Reinsurance prototype supports a wide range of operations for electronic placement and management of Property Catastrophe Excess of Loss (Cat XoL) treaties. Currently, they’re working on new functionality for technical accounting and claims.

Consumer Benefits:

- Contract certainty: users can compare the changes in contract versions and track the negotiation.

- Accuracy: DLT helps eliminate wasteful and error-prone operations like reconciliation and avoid data duplications.

Dynamis — P2P insurance company

Dynamis is a peer-to-peer income coverage app integrated with an Ethereum-based blockchain platform to offer severance insurance to employees in case of a layoff or resignation. Premiums are paid into a smart contract on the blockchain, and each employee gets a personal account with Dynamis. While there are no claims, premiums start to go down.

The startup relies on LinkedIn authentication to verify users and their employment status as the company’s insurance solution gets employees covered while they are searching for a new job. Additionally, applications are approved by other policyholders who function as evaluators supported by LinkedIn information.

Consumer Benefits:

- Fraud prevention: user accounts are verified in real time by other users.

- Auditability: claims are on a publicly auditable ledger to guarantee fair treatment for members.

- Cost reduction: automation replaces the traditional human workforce.

Lemonade

Lemonade, a US-based startup, states to be the first P2P insurance company in the property and casualty area.

Their business model presupposes a fixed fee from monthly payments and makes use of an algorithm to pay out claims immediately when conditions of a smart contract are met. The startup also offers a feature “Giveback” that allows using the premiums from a group of peers to support charity.

Consumer Benefits:

- Absence of paperwork: users access documents online and provide them to their insurer through a web portal.

- Transparent: users know what exactly their policy covers and choose a charity or fund for their unclaimed premiums.

InsurETH

This company is based on Ethereum and offers blockchain-based travel delay insurance. Founded in 2015, the disruptor offers automatic claims resolution based on detected flight delays, by using a blockchain algorithm. In case of a found delay, the app triggers an insurance claim, verifies the claim via a shared blockchain, and pays the user if the claim is legit.

Consumer Benefits:

- Automatic payouts: users don’t need to fill out forms, as the startup’s solution offers automated flight insurance with instant compensation.

- Lower cost: automated insurance claims that are handled on the blockchain reduce costs for all involved parties compared to traditional insurance procedures.

- Transparency: users can review the status of their claims anytime.

Teambrella

Teambrella is another innovative P2P insurance solution provider. The company lets users form teams focused on various assets that need insurance coverage. Team members get to vote and therefore decide the payout for each claim – the median of the team’s offers is paid to the claimant.

The platform, therefore, allows self-regulation of insurance policy’s terms and conditions by team members. This approach eliminates any incentive for the insurance provider not to pay out claims.

Consumer Benefits:

- Self-regulation: users form groups centered around specific risk areas and everybody is interested in offering the most adequate claim, so that when they raise a claim — they get the same treatment.

- Additional income: the platform allows expert users to become insurance brokers and vote on claims within their area of expertise on behalf of other users. Other users can appoint or fire an insurance broker at any point.

Blockchain PoC

As you can see, blockchain technology has all the potential to disrupt the insurance industry. The safe way to start exploring the benefits of blockchain is prototyping and developing of a proof-of-concept blockchain-based insurance solution.

Get in touch with us to discuss how smart contracts and blockchain can help you run a more profitable insurance business.