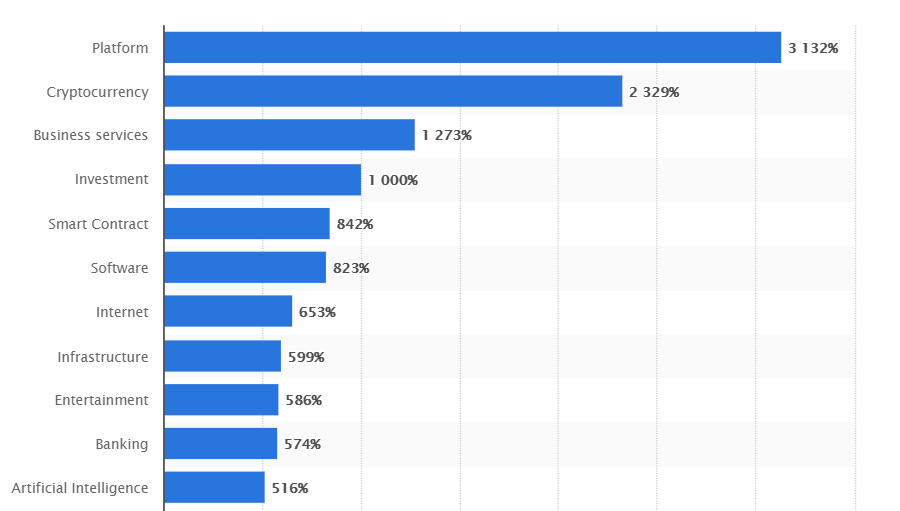

According to the latest data, there are more than 25 various industries that ICOs take part in. Most of the interest is centered around technologies, but fields like health, tourism, or energy also attract ICOs’ attention.

Source: Statista

While an ICO is a tempting endeavor for both startups and incumbents, it takes a lot of wits and hard work to launch a successful ICO.

So, read on to learn how to launch an ICO that helps you reach your business goals and make it out safe in the Wild West of ICOs.

What is an ICO?

First, you might be asking yourselves, what is an ICO? So, let’s answer that question. An ICO — aka Initial Coin Offering — is IPO on steroids. Only instead of equity in a company, investors get digital tokens. Because of that, ICOs also often go by such names as token offerings, token crowdfunding, etc. These token generation and distribution events happen on blockchains, and anyone holding bitcoins or ether can buy crypto-tokens during the ICO.

A token usually provides access to the product that the company seeks to bring to the market after raising funds — as a utility token. Or a token can also serve as a digital representation of some material or virtual assets — as an asset-backed token. Finally, cryptocurrency tokens function as a global medium of exchange.

Find out how Velvetech Developed a Crypto-Mining Browser

What Types of Initial Coin Offerings Exist?

Once you’re set on getting in on a new ICO, you need to know what types of Initial Coin Offerings exist. Currently, there are two options.

Private ICOs

Simple as it sounds, a Private Initial Coin Offering means that you engage a limited number of investors to raise capital. You can also choose the amount of minimum investment required to join your ICO.

Public ICOs

Another form of ICO is Public Initial Coin Offering, similar to IPO. It can be referred to as crowdfunding aiming to draw institutional investors and the general public. However, private ICOs are way more practical than public because of regulatory considerations.

How Does an ICO Work?

The key principle of ICO work is to raise capital by leveraging blockchain technology to issue and distribute tokens. It involves financial input from investors who get the project’s crypto coins in return. Obviously, their interests should be aligned with the whole ICO strategy.

When you’ve set up an Initial Coin Offering, tokens can be traded in exchange for other cryptocurrencies like bitcoin or fiat money like US dollars or euros.

How to Create a Successful ICO

The public investing in ICOs is getting more sophisticated and expects more from new market entrants. So, putting together a thought-out ICO strategy is becoming crucial. Here are the main steps to launch a successful ICO and reap the advantages of your initial coin offering.

1. Do I Need an ICO?

The first thing you need to decide is whether you need an ICO at all. Yes, you can potentially get funded over the course of two to three months, or days if you are lucky, with an ICO. But the blockchain industry pundits stress that your token should blend with a product you are developing and potentially bring value to the underlying platform — the blockchain.

Otherwise, if pegged as yet another virtual currency, your token is likely to raise little interest with investors joining a long list of other 10,303 cryptocurrencies.

Solving a unique problem and adding value to the blockchain community is essential for your ICO to succeed. For that reason, some ICO projects choose to focus on specific purposes, like building apps for the realities of Web 3.0 or zeroing in on an industry like finance and developing a token for trading.

2. Where Do I Launch an ICO?

Geography does play a significant role in setting up an ICO as different countries have different policies toward running them. Countries that appear on the ICO-friendly lists are:

- Switzerland

- Singapore

- Hong Kong

- Lichtenstein

- The British Virgin Islands

- The Cayman Islands

Take a look at Dr. Andreas Glarner, a partner at the MME Crypto Team, as he sums up the ICO regulations in Switzerland:

It’s worth mentioning that if you offer tokens to US residents, this automatically makes you subject to the SEC regulations. Double-check that you clearly communicate the purpose of your token. In particular, you might want to avoid calling it security or promise high returns on investment, which flags a token for an inspection right away. Apply a Howey Test to check if your token belongs to securities.

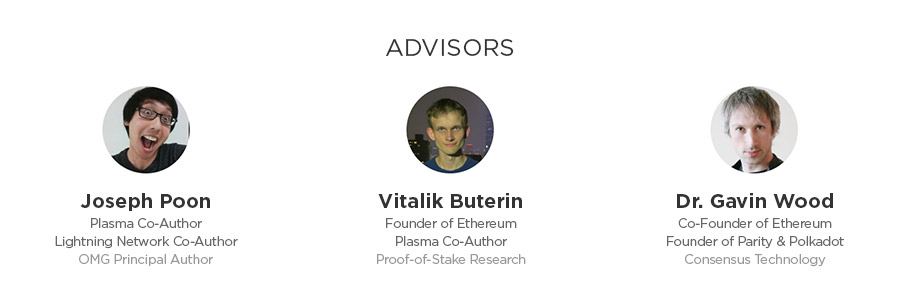

3. Get the Team & Advisors Board Together

Building a skilled team is a self-explanatory must during ICO development. Founders can take it only as far as the team can run: someone needs to develop the product; other team members will work on marketing, providing support to your community, etc.

Besides the core team, you will need advisors. While not everybody can get Ethereum founders on their board of advisors, you should remember that Vitalik was publishing his white paper once too.

Ideally, one of your advisors will have a law degree and some experience in assisting other ICOs. If not, do get a contract lawyer working with securities to make sure you are complying with KYC and AML legislation.

Your Focus with the Team

- Engineers with proven experience in the blockchain and smart contract technologies who will build out your product

- Growth hackers for business development

- Transparent and cohesive team members’ CVs, LinkedIn profiles

- Contributions to the open-source community is always a plus

4. Prepare Product Roadmap

Your product is the main reason you plan to launch an ICO, remember? A clearly articulated product roadmap with a cost breakdown helps with establishing an image of a promising ICO.

As a result of market saturation, crypto investors perform proper due diligence before buying tokens. Savvy investors will check how often your dev team commits code to GitHub or other source code repositories.

At the same time, some projects, especially those aiming at developing new blockchains, require substantial funding even for the MVP phase. This is because there is clearly a cost to developing an MVP.

If you don’t yet have an MVP, a product roadmap is especially crucial. What it can do in such cases is show a founder’s ability to take his or her vision and turn it into a revenue-generating product, through a clearly defined set of steps.

5. Get Out a White Paper

A white paper has become a must-have attribute of any ICO: it instills trust and a sense of credibility in your potential investors. Take a look at a crypto expert ripping through a white paper to see what you can do better.

Putting a white paper front and center on your website is the first thing to do before reaching out to the crypto community. As soon as serious investors land on an ICO campaign website, they start looking for a white paper with details on a product roadmap, industry and competition landscape, tokenomics, etc.

At the minimum, you must reserve some space in your white paper for the following bits:

- Problem and solution definition

- Market & competitive environment analysis

- Details of your token economy

- Team overview

You may want to review the white papers from the 10 most successful ICOs to get a head start with your white paper.

Collin Thompson, a co-founder of Intrepid Ventures, suggests that you also publish a position paper before releasing a white paper. The position paper is much shorter — two or three pages long or a point-blank one-pager. You can use the position paper to gather the initial feedback and write a killer 30-page-or-so white paper.

6. Build Your Community

Since your potential investor is practically anyone with a crypto wallet, you need to target them via all available marketing channels to generate interest in the upcoming ICO and the cryptocurrency. Running social accounts goes without saying, however, the tech-savvy public will expect at least a presence on Reddit and BitcoinTalk forums.

Next on the marketing to-do list is adding your ICO to ICO listings — sites displaying past, active, and scheduled ICOs. Just search for ICO listings on Google to get a nice list.

Doing interviews and visiting conferences goes a long way as well. Besides getting a chance to pitch your ICO to industry veterans, you will also make necessary connections to get that special advisor on your advisory board.

Since ICOs are still relatively new, it’s only natural that people will bombard you with myriads of questions. So, make sure you have a public Slack, Telegram, or Discord channel set up to chat with your supporters.

7. Pick Token Sale Model

Currently, an ICO launch mostly takes place on the Ethereum blockchain platform because it supports smart contracts — the prime tool for automating token generation and distribution. We’ll talk about this in a moment. Meanwhile, let’s look through some of the popular models of token sales.

Soft Caps

The soft cap is the minimal amount of funds the ICO needs to raise to become successful. When ICOs fail to reach their soft caps, contributors need to request their investment back.

Hard Caps

The hard cap is the maximum amount of funds allowed for raising. An ICO stops once it has reached the hard cap.

Uncapped with Fixed Rate

- ICO’s duration is not limited

- Fixed token-to-cryptocurrency exchange ratio

- Early contributors get a discount

- No limit on the number of contributors and amount raised

Capped with Fixed Rate

- ICO’s duration is limited to several months

- Fixed token-to-cryptocurrency exchange ratio

- First-come-first-serve basis for tokens offering

- The number of tokens available for sale is limited

Check out this brief video detailing an innovative token sale model employed by Raiden to grasp the idea of the next model we will discuss:

Dutch Auction

When using the Dutch Auction approach, you don’t have to set the price of a token in advance. As soon as the sale starts, a smart contract begins accepting bids until all tokens are sold. All bids align from high to low, and higher bids get priority in receiving tokens.

Hybrid

As the number of ICOs continues to grow, companies keep innovating token sale models trying to mix different approaches. The goal here is to get tokens distributed among a quality user base, interested in your product and not planning on immediate speculations as soon as the token becomes available for trading.

One thing to note here is that overcomplicating the sales model for ICO could repel your early supporters and make the ICO vulnerable to attacks.

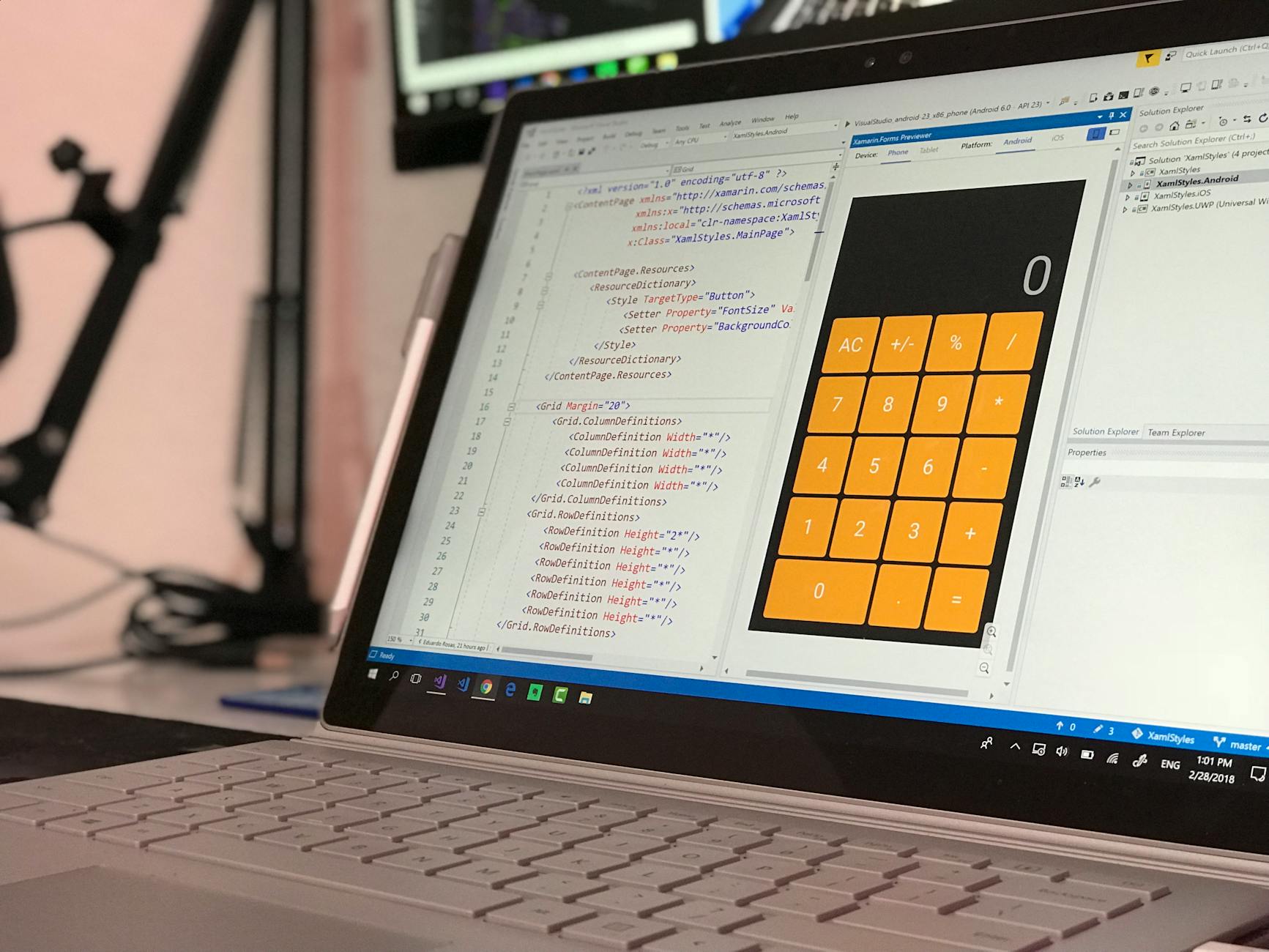

8. Develop Smart Contract and Mint Tokens

To generate the tokens and automate the token distribution process, you need to develop a smart contract. The industry standard is the ERC-20 token. It’s a specification that outlines smart contract parameters for an ICO.

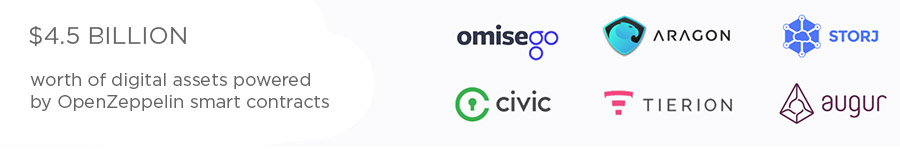

In everyday practice, companies vouch for smart contract templates provided by OpenZeppelin on an open-source basis. These smart contracts have been hard-tested by the blockchain industry veterans, who have already run a successful ICO. And some extra caution with your investors’ contributions can never hurt — as soon as a smart contract is deployed to the blockchain, you have very little control over it.

Therefore, you should audit your smart contract before deploying it to Ethereum. Usually, after rigorous internal testing, companies make their smart contracts available for a public review and offer bug bounties for reported glitches.

Besides developing a smart contract for minting tokens and distributing them among your supporters, you might also want to develop a web app with UI for the personal account. Such an investment management application will help contributors monitor their assets and access project info at any time.

9. Launch ICO

When the day X comes, just as programmed in an Ethereum smart contract, the ICO will begin automatically. It’s always a good idea to create a web interface to allow live demonstration of the token sale process.

10. Post-ICO Life

Let’s hope that with the right team your ICO will launch successfully. From this moment, your company will be closely watched by blockchain experts, multiple ICO listing sites, homegrown experts with a strong following on YouTube and other social networks. It’s not the time to rest on your laurels.

It’s vital to keep communication flowing with your community of supporters, provide transparency with the deliverables, and certainly keep building your great product!

Now, you know how to start with the launch of an ICO and hopefully are inspired to keep pursuing your project. Since companies often need help with ICO strategy development and execution, Velvetech is here to help.

Let us know if you have any questions about launching a successful ICO or developing smart contracts and other ICO technology. Velvetech will be happy to help you run a successful ICO!