The client is an institutional-facing DeFi startup aiming to simplify access to algorithmic yield strategies

The Client’s Request

The client set out to build an investment management software that could combine automation, modularity, and compliance without compromising decentralization. They wanted to allow licensed entities or fund managers to configure and run yield-generating strategies, while investors would simply select from predefined offerings.

Their vision called for a strategy aggregator that connects algorithmic yield models with an intuitive interface for risk visibility and investor engagement. From day one, the platform had to be KYC-ready, role-based, and modular, while maintaining a non-custodial structure and preparing for SEC and EU compliance frameworks such as Reg D, Reg S, and MiCA.

Having built numerous fintech and blockchain products for regulated markets, Velvetech, a decentralized finance development company, was selected to architect and deliver the MVP in full.

Find out Why MVP Apps Fail and How to Build a Killer One

The Process

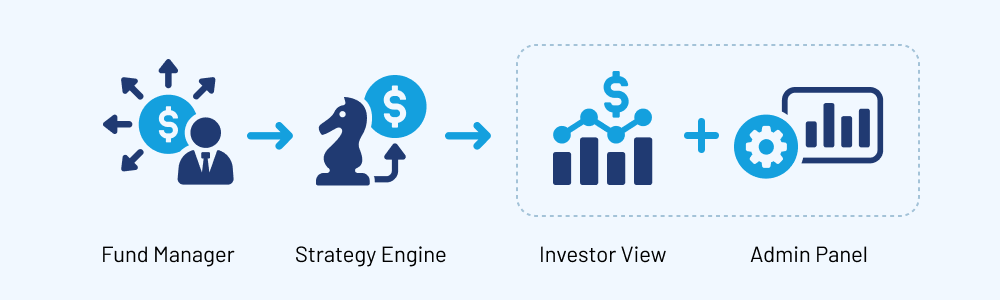

We built a full-stack strategy-driven DeFi platform that brings together smart contract architecture, modular backend services, and adaptive web interfaces for both investors and administrators. The solution enables non-custodial portfolio management, real-time performance tracking, and regulatory alignment within a scalable, institutional-grade environment.

Strategy Engine Development

At the heart of the platform lies a custom strategy engine that empowers fund managers to launch and manage yield strategies. These can include staking, delta-neutral models, or more advanced logic such as AI-driven allocations. Strategy modules are fully programmable and operate on-chain, ensuring transparency, security, and automation of fund segmentation and fee distribution.

Investors can access the platform through a configurable dashboard that displays relevant metrics based on their user tier, including APY and exposure to capital inflows. On the admin side, the interface supports investor onboarding, compliance workflows, and control over assets under management, all backed by integrated KYC/AML providers.

The system also accommodates optional utility-token mechanics to support incentive structures and future governance, while avoiding classification as an investment instrument.

The final MVP is modular, white-label ready, and built for repeatable deployment, enabling other financial platforms to reuse the infrastructure and tailor it to their own strategies and regulatory needs.

Check out how we delivered an On-Chain Tokenization Platform

Result

Velvetech delivered a production-ready DeFi infrastructure layer built around compliance, investor usability, and smart contract automation. The MVP enables real-time risk tracking, verified onboarding, and secure strategy execution within the scalable, API-first framework.

By aligning with real-world regulation while preserving the open architecture of DeFi, the platform offers a powerful blueprint for compliant decentralized investment tools.

Our specialist will contact you to schedule a personalized consultation within one business day.

Velvetech offers complimentary consultations; after which, we will provide you with a proof of concept in just 3 days, an accurate outlook of the cost and timeline of your project and a competitive estimation, and an assembled team – ready to start your project within 7 days.

Proof of Concept in

Start Project within