Some financial institutions like banks are skeptical of blockchain and view it as something that could compromise their business. Recently, Mark Cuban, the billionaire investor who is a huge proponent of decentralized finance, echoed these sentiments and went as far as to say that “banks should be scared”.

However, this isn’t necessarily true. Sure, at first glance it may seem like blockchain can put banks out of business, but if you shift your perspective just a little — you’ll see that it provides a myriad of opportunities and can serve as a key differentiating factor. Today, this is precisely what we’d like to prove.

So, keep on reading to find out how blockchain-based applications can be used in banking and to determine whether their development is something you’d like to pursue.

How Can Blockchain and Banking Work Together

First of all, let’s get on the same page about the potential of blockchain in banking.

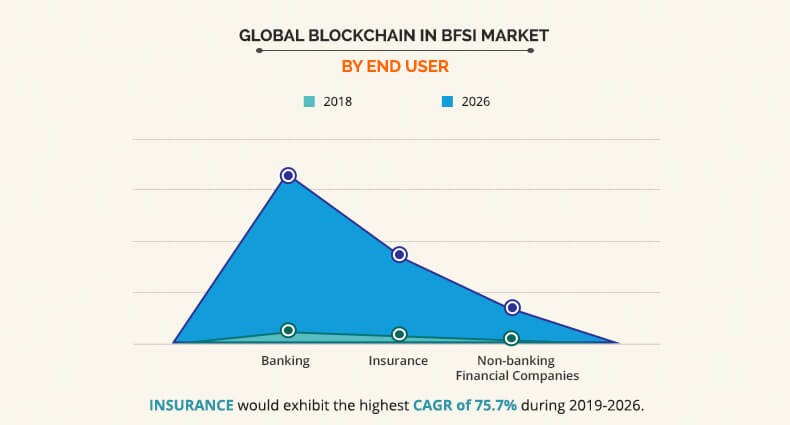

According to research, the blockchain in the BFSI market size is projected to reach $22.46 billion by 2026. Moreover, the banking segment, in particular, is expected to continue dominating the market in terms of revenue generation.

So, it is clear that forecasts are quite optimistic and we think it’s with good reason.

As you may know, blockchain is a distributed ledger technology that records transactions between parties. It can help eliminate the need for middlemen through smart contracts, which self-execute once certain conditions are met.

Find out Why Blockchain in Finance is The Next Big Thing

Overall, blockchain technology boosts security, improves efficiency, and reduces operational costs. Thus, it can be of high interest to banks who want to innovate and keep up with disrupting digital trends.

Already wondering which areas of banking blockchain solutions can improve? Let’s take a look.

Payments and Remittances

One of the primary use cases of blockchain in banking centers around payments and remittances. Specifically, the technology can facilitate higher security and lower payment processing costs for clients and banks themselves.

For example, cryptocurrencies can serve as digital money and a method of sending payments around the world. That way, transactions occur within seconds and in a much more secure manner. So, simply by offering cryptocurrency options to their clients, banks can deal with the inefficiencies of current systems.

Discover How to Create Your Own Crypto

By embracing blockchain in this way, banks can expand their service offerings and bring new products to the market. In the end, they’d even start competing and differentiating not only from other banks but also from the emerging fintech startups. Naturally, that’s something any banking industry player is interested in.

Clearance and Settlements

Typically, bank transfers can take around 3 days to settle. A duration that’s hardly in line with the current pace of the world we live in. This not only causes frustration for customers, but also for the banks themselves.

In order to carry out a bank transfer, a system of middlemen has to be passed. It can include correspondent banks, custodial services, and other financial institutions that serve as intermediaries. As a result, only after the balance is reconciled across the entire network, can the transfer be settled.

The extensive involvement of middlemen leads to higher costs and risks because each intermediary adds fees and potential errors to the transaction. Not to mention, the added time required for each institution to let the transfer go through.

So, how can blockchain come into play here?

By turning to decentralized ledgers, banks could keep track of all transactions more efficiently and speed up the entire process. Instead of relying on SWIFT, banks can settle transactions directly on the blockchain network. That way, banks would simultaneously benefit from lower processing fees and the improvement of services they provide to customers.

Loans and Credit

Traditionally, when a customer applies for a bank loan, the institution underwrites it based on a credit reporting system. The risk associated with giving out a loan is assessed by looking at various factors that speak to the customer’s ability to pay back the specified amount. Things like credit scores, debt-to-income ratios, and homeownership status are all taken into consideration. In the USA, this information is provided by specialized credit agencies.

This level of centralization not only increases the risk of errors in credit scores, but also the potential for sensitive information leaks. With so much personal data concentrated in just a few places — the institutions become vulnerable and not secure.

With adding blockchain to lending software solutions, everything changes. By leveraging this innovative technology, banks can tap into a more efficient and safe way of processing loan applications. Specifically, with the help of an encrypted, decentralized ledger, customers can start applying for loans based on their global credit scores and not be afraid of a sensitive data leak.

As you can imagine, this improvement in service and an increase in the number of solvent customers make blockchain and financial software development a true interest for banking institutions.

Trade Finance

The fourth area of banking that’s prime for disruption by blockchain is trade finance. It involves everything concerning domestic and international trade and commerce. Typically, banks play an intermediary role and make these transactions feasible.

To this day, many trade finance activities involve time-consuming manual processes and paperwork. However, with blockchain that doesn’t have to be the case any longer. Instead, exporters and importers can make use of smart contracts and cryptocurrencies and set up rules that will dictate automatic payments.

By turning to blockchain and decentralized application development, banks will be able to provide those involved in trade finance activities with the chance to execute transactions more transparently and efficiently. Thus, once again expanding their service offerings and winning over competitors who stick to the traditional ways of doing things.

Accounting and Auditing

Another way to apply blockchain technology in the banking sector is by incorporating it into accounting. This business area is riddled with regulatory requirements. Thus, making it one of the most difficult ones to digitize and transform as the era of Web 3.0 approaches.

However, despite the widespread use of traditional double-entry bookkeeping systems, there is an opportunity for blockchain applications in banking to revolutionize the field.

You see, by adding transactions into a blockchain-enabled joint register, they can be stored in a distributed, secure, and more transparent manner. The platform can verify all of the entries and keep the records cryptographically protected. Thus, letting business managers rest easy knowing that the integrity of electronic files is top-notch and no sudden compliance issues should arise.

Know-Your-Customer and Fraud Prevention

The final blockchain in banking disruption we will discuss today has to do with fraud prevention and customer identity verification.

Through the process of “know your customer” (KYC), banks onboard new clients, verify their identity, and ensure that the information provided is correct. Naturally, this process takes some time and, consequently, money. However, it can’t just be bypassed because it’s precisely the thing that helps battle fraud. Once again, blockchain banking systems can come to the rescue.

By offering blockchain-based technology, banks can allow customers to use digital fingerprints as unique identifiers to be stored on the distributed ledger. “What’s the point,” you may ask. Well, the identification could then be used by any bank on the network, thus letting customers avoid going through the entire KYC process with new applications.

“We estimate blockchain-based solutions for customer onboarding can create up to $1 billion of savings in operating costs for retail banks globally and reduce regulatory fines by $2 billion to $3 billion. In addition, we expect blockchain solutions to reduce annual losses from fraud by $7 billion to $9 billion.”

— McKinsey

In essence, customers will have to confirm their identity once and not have to go through the registration proceedings with every financial service provider. So, if more and more banks turn to blockchain and adopt this verification opportunity, clients will be leaning towards them and away from those that still require a long and arduous KYC process.

Lastly, the reliance on blockchain carries with it ample security benefits due to its decentralized nature. Thus, customer information will always be stored in the safest manner and boost the reliability of the bank in question.

Examples of Blockchain Technology in Banking

You now know some of the top blockchain use cases in banking and how they are disrupting the industry. Yet, if you’re still skeptical, seeing real-life examples may be helpful. The truth is, some major banks are already turning to blockchain and leading the way by embracing innovative technologies. Let’s take a look at the top three examples.

J.P. Morgan

Last year, J.P. Morgan launched a dedicated blockchain unit and created a peer-to-peer blockchain-based network — Liink by J.P. Morgan. Then, just a few months ago, the company announced that it is starting to rely on blockchain to improve fund transfers between global banking institutions.

Specifically, J.P. Morgan rolled out a new solution called Confirm, which is meant to reduce the number of rejected or returned transactions due to invalid payment details. As a whole, it is expected to lower costs for sending and receiving banks.

Citigroup Inc.

Following suit, Citigroup’s Global Head of Foreign Exchange, Itay Tuchman, stated that the bank is considering moving into cryptocurrency markets. Primarily, due to surging interest from existing clients. According to the Financial Times, Tuchman believes that “crypto is here to stay and we are just at the very beginning of the market.”

Goldman Sachs Group

Finally, Goldman Sachs is also not stirring clear of blockchain technologies. In fact, it has joined the blockchain network created by J.P. Morgan. On June 17, 2021, the company made its first trade by swapping a tokenized version of a U.S. Treasury bond for JPMCoin.

With so many leading banking institutions embracing blockchain, the only question that remains is — why aren’t you looking into it too?

Is It Time to Embrace Blockchain Technology in Banking?

Despite the nascency of blockchain in banking, key players are already embracing it and looking forward to the future. The use cases of the technology can be revolutionary for various areas of banking and now isn’t the time to fear the worst. Better yet, focus on seizing the opportunity and consider how blockchain can help solve your business challenges. After all, there are ample advantages of blockchain in banking and it’s best you capitalize on them before your competitors do.

Running a financial services firm requires a lot of work, and keeping track of all the latest digital innovations can get overwhelming and comes with a cost. So, if you’re looking to partner with a company that can take the software development work off your hands — don’t hesitate to reach out.

Velvetech’s team has vast experience in delivering custom software solutions to financial services companies and leveraging blockchain to enhance security, reduce costs, and maximize efficiencies. We’d be happy to discuss any software project that’s on your mind and answer the questions you have! Let us help you acquire blockchain banking solutions that cater to your needs and solve your unique business challenges.