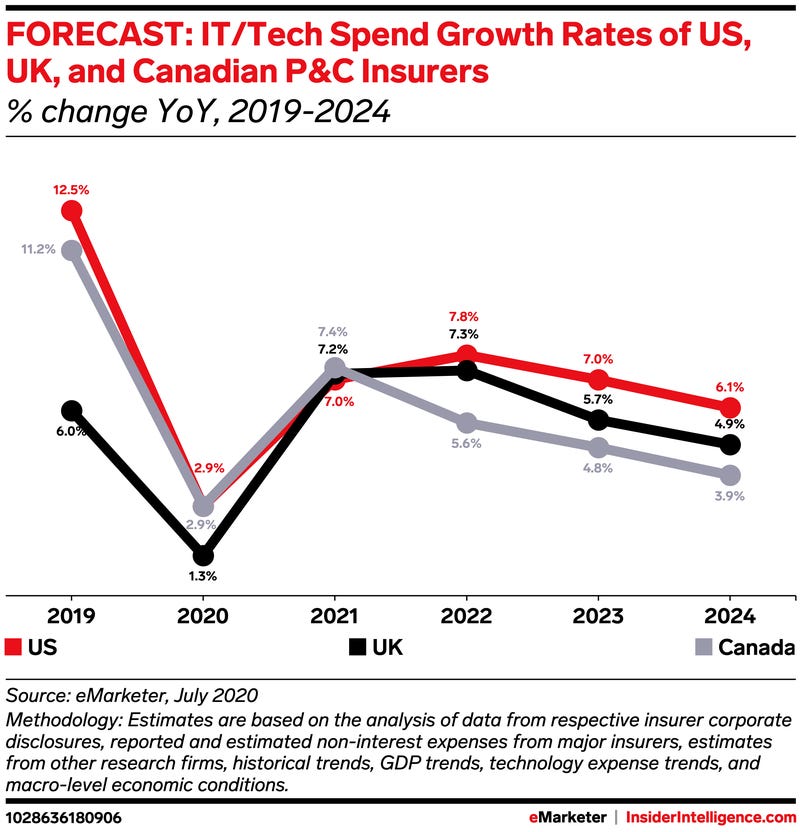

Losses suffered during the pandemic have caused US P&C and life insurance companies to cut their tech spend last year. However, as things begin to turn around in 2021, so do the investments in IT across the global insurance sector.

According to Business Insider, “insurers are looking to better meet customer expectations, cut costs, and adjust to widening coverage gaps via digital technology.”

The insurance brokerage market, in particular, is being driven by the integration of IT and analytics solutions. It is expected to reach $395.04 billion by 2027. So, it’s safe to say that software development will be top of mind and a key differentiating factor for this business sector.

In this article, we will discuss software for insurance agents and the challenges it can solve for your brokerage business. Moreover, by the end of the article, you’ll be able to identify whether custom development or an off-the-shelf product is right for you.

What Do Insurance Brokers Do?

First off, let’s make sure we are all on the same page. Insurance brokers are intermediaries. They don’t work for insurance companies. Instead, they help find the best coverage amongst a variety of insurance carriers. A broker will compare the terms and conditions of multiple insurers and provide its customers with an unbiased recommendation.

How Can Software Solve Insurance Broker Challenges?

Insurance brokers usually face challenges related to workflow efficiency, customer experience personalization, sales call performance, quotes and commissions management. Luckily, there is now software that can help with all these areas.

Let’s look at some of the top challenges insurance brokers face and how effective software can solve them.

1. Workflow Efficiency

Insurance brokers have to deal with a few stakeholders at work: customers, carriers, and the agency itself. To perform at the highest level and manage everything efficiently, brokers have to be on top of their planning game. Sometimes that can get difficult.

Storing all customer and carrier information in one place, finding and sharing it quickly is not always easy. As you may have guessed, there’s a solution to that.

Automation and technology adoption are the leading IT priorities for all industries. Thus, workflow automation is the first thing to turn to when looking to improve efficiency. Generally, what you will see after implementing these tools is:

- Elimination of repetitive tasks

- Reduction in administrative spending

- Increase in workflow efficiency

- Decrease in error rate

For an insurance broker, these benefits will immediately free up time to focus on more strategic and valuable duties like policy terms negotiation and building relationships with clients.

See how a Dental insurance consultant enhanced their efficiency with automation software

2. Customer Experience Personalization

Thanks to the power of the internet, people are more informed than ever. They are bombarded with information and will flock to your competitors if unsatisfied with the service they receive.

Insurance brokers who want to stand out need to take a personalized approach to customer service and deliver the right message at the right time and place.

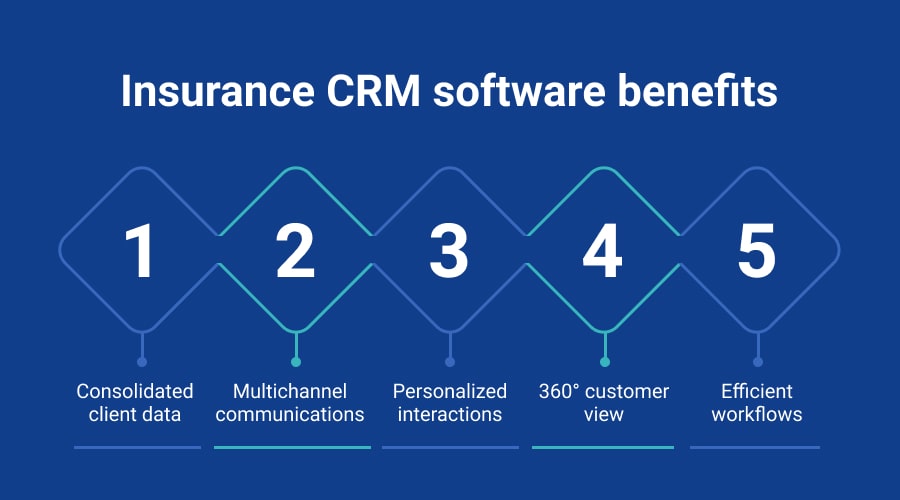

Developing a personalized approach starts from consolidating all the valuable customer data in a CRM system.

CRMs provide a central place to store client data and manage all communications. Most importantly, they help personalize customer interactions through rule settings. For example, you can set up when certain emails go off based on client actions (or inactions).

By maintaining and customizing client engagement along the entire customer journey from a single platform, you simplify your life. Instead of repetitive manual work, you can focus on your contacts segmentation and creating highly personalized campaigns.

Need to pull up customer history to look over past interactions? Want to make a personalized risk questionnaire for a client? No problem. It’s all possible and without needing to learn to code!

Low-code CRM platforms are popular with companies that don’t want to waste time and resources on expanding in-house technical knowledge. This is why they can be perfect for insurance brokers who want to speed up digital transformation efforts.

User-Driven Approach

Watch our webinar and learn the top ways of reducing poor user satisfaction, low adoption rates, and decreased loyalty.

3. Sales Call Performance

Sales are essential for any organization. They mean revenue and continuous growth. As a result, sales teams are often pressured with KPI increases, causing stress and burnout from multitasking.

In the insurance business, brokers have to correctly identify the life nuances of each individual and find the best fitting insurance among multiple ones. So, is there a way to do that more effectively and get to the right selling point faster?

Yes. It turns out there is. One of the areas that software can enhance is calls.

First off, you can get call analytics that provides an opportunity to get all insights on customer interactions. Timing details, conversation recording and transcription are all available to you. Moreover, you can check if you’ve covered all your bases during the call. Were the proper questions asked? Was the phone number confirmed? And so on.

On top of that, you can also use real-time speech-to-text transcription. It essentially helps guide a broker during the conversation. Thus, ensuring that you don’t miss any crucial step and provide the best service possible.

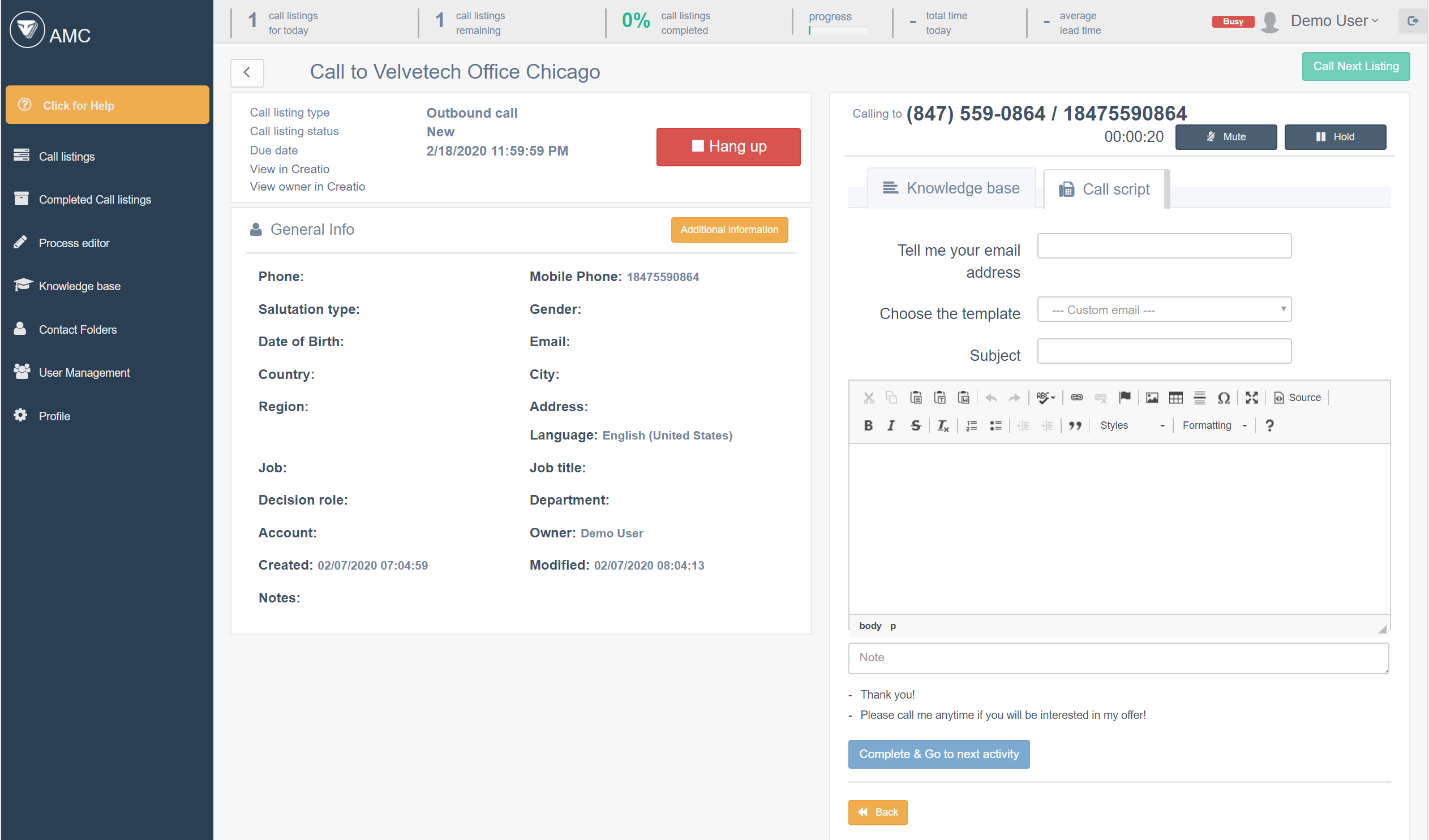

Discover a real-time strategic platform for a top insurance agency & brokerage from Chicago:

Another boost to your sales performance can be a Power Dialer. With its help, an agent can make mass calls from a single interface, record all the needed information, and automatically sync it with the CRM before switching to the next customer. It’s a productivity powerhouse for outbound callers.

Conversation intelligence tools are only beginning to get traction right now, but those who have implemented them are already seeing results. If you want your company to get a sales boost — it’s worth checking this software out.

Gaining Control of Customer Engagements

What if every customer could deal with your single most effective agent?

4. Quote Generation

Competition between insurance brokerage firms is high. It forces key players to chase after innovation at every turn and improve business processes along the way.

Traditionally, insurance brokers take from a few minutes to a couple of days to generate quotes, depending on the insurance type. Customers may not want to wait that long. The broker has to gather data, record it, validate, and generate quotes. In the meantime, the prospect is just sitting at home and waiting impatiently.

Hence, to stand out from the competition, insurance brokers must ensure fast and accurate quote delivery. Quote software can help with precisely that.

It can come in the form of an application to install on your devices or a website add-on for instant quote generation. Either way, you’ll be able to quickly provide quote estimates to customers who don’t want to wait too long and are in a rush to make a decision.

So, don’t keep your customers waiting when you can ease their insurance hunt process.

5. Commissions Streamlining

For insurance brokers, commission management can be a challenging process. Working with multiple carriers that each have their own commission policies can lead to confusion and errors.

That’s why commission management software is something insurance brokers are looking into. Usually, these solutions help streamline insurance commission processes through automation, tracking, and management. Specifically, such software can help organize and monitor sales incentives, manage commission splits, and process payments.

Increased productivity, minimized human error, and happier brokers are the typical results of effective commission software integration.

What Type of Broker Software is Right for Your Insurance Agency?

Company preferences, existing workflow processes, and many other factors affect the kind of software brokers choose to use. Each agency has its own setup. Software for life insurance agents and health ones may slightly differ. After all, the insurance industry encompasses multiple sectors. However, most have insurance broker management software that incorporates a few or all of the following functionalities:

- Accounting

- Sales performance tracking

- Customer relationship management

- Administration issues handling

- Policy management

- Claims processing

- Commissions streamlining

How to Approach Agency Software Development?

Now that you’ve seen how software tools can solve your insurance brokerage challenges, you may be wondering, “how do I get started, and is there a tool that can help me with that?” We are glad you asked.

When insurance brokers choose to innovate and invest in software to improve their businesses, they inevitably face the following question. Should we choose:

- A ready-made product?

- A ready-made product, but customize it to our needs?

- Totally custom software?

The choice is, of course, very personal. Ready-made products give you instant software access. Alternatively, you can get an off-the-shelf one and if it doesn’t fulfill all your needs, have extra features added to it. Finally, custom software lets you obtain an exclusive and tailor-made solution that no other company will have.

Let’s take a closer look at the two opposite ends of the spectrum — ready-made software and custom development.

Ready-Made Broker Software Examples

Many off-the-shelf solutions are already on the market for those who can’t wait to get started. Below, we’ll provide a few examples for you to look into.

Jenesis Software

A cloud-based platform that helps insurance agents with document and policy management. Additionally, it provides marketing automation, claims and commission management tools.

Creatio

A low-code platform for process management and CRM. Includes features that help accelerate sales, marketing, and customer service. Has vast customization opportunities to help set up additional features that are most relevant to your business.

CaptivateIQ

A solution to help automate commission tracking. It lets you connect to any data source and pull all the essential information to automate the commission process.

Now you have a couple of ready-made solutions to check out, but what if none of them entirely cover what you need? Or, perhaps they have too many modules that you don’t even plan to use. In that case, we advise you to keep reading and learn about custom software development options.

Should Insurance Brokers Turn to Custom Development?

We’ve briefly touched on some examples of ready-made solutions above, but to make an informed decision, you should also know the pros and cons of custom insurance software development for brokers. Let’s dive in.

Benefits of Custom Insurance Broker Software Development

1. Tailor-Made Features

Custom software does not serve as many businesses as possible. On the contrary, it keeps your business and your needs top of mind. These solutions cater to your business specifically, thus allowing you to pay only for what you need and avoid unnecessary features.

2. Continuous Support

Depending on the development route you choose, outsourcing or building in-house capabilities, you will have varied degrees of IT support. However, a development team that values your business will always be there to provide any needed assistance with your solution.

The dedicated team that created your insurance broker software application knows your business and industry nuances. It will be able to efficiently tweak any problems and handle new requests if they arise. On the other hand, an out-of-the-box product may be used by thousands of people and updated (or not) based on the needs of the majority.

3. Data Security

Since bespoke software is tailor-made for your business, it usually adheres to all the highest security standards relevant to your field.

As an insurance broker where compliance with regulations and data security is of utmost importance, you can see this as a major benefit of choosing the custom development route.

4. Cost-Effectiveness

While custom-built software may seem more expensive because of upfront costs (we’ll talk about that in the next section), the recurring fees of ready-made solutions should also be accounted for when making your decision.

Unlike tailor-made solutions, out-of-the-box ones may have hidden costs. They come in the form of add-on features, customization services, number of active users, and the like.

Choosing to go with a personalized solution, on the other hand, lets you maintain control of your spending and even approach implementation iteratively. You don’t have to change everything at once.

5. Exclusivity

With a custom-built solution, nobody else in your field will have an identical one. This will allow you to differentiate from the competition.

If you take a thorough approach, you’ll be able to make any changes to the solution that you deem fit and always stay ahead of your competitors.

Drawbacks of Custom Insurance Broker Solutions

1. Upfront Costs

Let’s get rid of the elephant in the room. Yes, upfront costs of custom software development can cause anyone to stare wide-eyed onto the price sheet.

However, when you consider that you’ll have your software development team working to deliver precisely what you need as an insurance broker — it may not be such an overwhelming number. Not to mention, the costs depend on the type of outsourcing you may choose to do.

2. Non-Immediate Implementation

Sometimes you are so eager to get started with new software that you don’t want to wait to develop a bespoke solution. Unfortunately, with custom software, that’s inevitable.

Ready-made tools just require you to sign up, pay, and you can get started, while the personalized nature of bespoke solutions requires some lead time.

3. Employee or Partner Search

Whether you choose to develop custom software in-house or look for a trusted partner — you will need to spend some time on the search. HR processes and comparing various vendors can also postpone the start of your software development.

For every insurance broker, deciding whether to invest in custom software development or an out-of-the-box solution remains very individual. But there’s no doubt that investing in suitable software should be one of your main priorities in 2021 and beyond.

So, instead of putting off the process, reach out for a consultation on your unique business case and get started with software development for insurance agencies that’ll help surpass all your competitors.