Pretty much every industry, in one way or another, has been disrupted with the appearance of smartphones, mobile apps, and online payments.

Now, it’s easier than ever to find what you need, checkout, complete a purchase, and receive the product or service. Or, at least, it should be, since any complication or bottleneck in this process results in cart abandonment and uncompleted purchases.

Hence, regardless of whether you’ve started mobile app development or are just thinking about it, you need to know how you’ll carry out transactions if it’s a consumer-facing solution that you’re after. One option is to integrate payment gateway services into your application.

With the global spending in mobile apps hitting a record $64.9 billion in the first half of 2021, it’s easy to see why app owners don’t want to miss out on any sales opportunity.

So, today, we’ll explain what a payment gateway is, how it works within a mobile app, the benefits of such an integration, and some key considerations to think about before getting started.

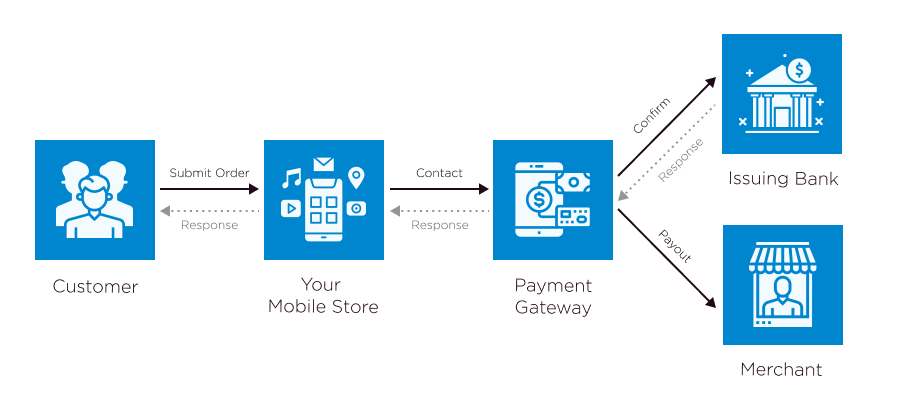

How a Mobile App Payment Gateway Works

A payment gateway for mobile apps is essentially a service for processing purchases within an application. With the help of encryption and security protocols, it serves as a mediator between the customer and the merchant, thus facilitating transaction completion.

The process is relatively simple and you’ve likely come across some of the most popular payment gateway integrations when completing your own online purchases. For instance, solutions like PayPal, Stripe, Braintree, and WorldPay are some of the most used ones in mobile applications.

At this stage, it’s important to note that external gateways aren’t the only option for processing payments within a mobile app. In fact, you may have to forego them if your application provides mobile products that operate within the solution. For example, if you sell personalized training or diet plans for an additional price within a fitness app.

Discover how Velvetech developed a Fitness App to Personalize Client Experiences

In this case, you’ll have to embrace in-app purchases on iOS or Android and be prepared to pay 15-30% of your revenue to Apple or Google. So, it’s only if you’re selling physical products or services through your mobile app that you should process payments through a third-party payment gateway service provider.

Payment Gateway Integration Benefits for Mobile Apps

Now that you understand what payment gateways are actually used for, it’s worth talking about some of the benefits they can bring to your business. After all, it’s best to know what you’ll be gaining from adding this step into your development process.

Customer Service

First and foremost, a payment gateway in a mobile app can simplify the buying process for your customers.

By allowing your users to pick the payment option they find most suitable, you increase the likelihood of them actually completing a purchase as well as your service level. Moreover, your customers can save their preferred payment methods within the app for faster checkout or set up recurring billing.

In both cases, you arm your customers with the ability to dictate how they wish to use your application, thus catering to their needs and increasing satisfaction.

Discover how Velvetech built a Customer Satisfaction-Boosting Medical App

User-Driven Approach

Watch our webinar and learn the top ways of reducing poor user satisfaction, low adoption rates, and decreased loyalty.

International Expansion

With the right payment gateway, you allow your app to carry out international transactions and receive payments from around the globe. This is great for businesses that are looking to expand into new markets.

After all, you’ll be able to minimize challenges associated with currency conversion, local regulations, and so on, since, with a payment gateway, it’s all simplified.

Revenue Growth

Providing more payment options to your clients and widening your customer base by processing transactions internationally will naturally reflect positively on your bottom line. Primarily, because you make it easier for interested customers to actually complete their purchases.

Key Considerations for Mobile App Payment Integration

Before you start questioning how to integrate a payment gateway into your mobile solutions, it’s important to understand some key considerations that will arise along the way.

1. Target Audience

Prior to choosing a payment gateway provider for your mobile application, it’s a good idea to check whether they operate in your target locations. After all, you want to have the ability to process transactions in the countries your app users are from.

So, ask yourself which markets are your priorities? Or, is your business global and you need to make sure the gateway supports multi-currency payments?

Whatever the case may be, you want to offer your target audience’s preferred payment options, otherwise you run the risk of losing them. So don’t forget to study target audience preferences, ideally before you even begin building your first app.

2. Merchant Account

A merchant account essentially lets you accept and process electronic payments and serves as your business’s online bank account. When setting it up, you’ll be faced with two options to choose from depending on your needs. Let’s take a closer look at each one.

Dedicated merchant account: one that is allocated solely for your business. It provides you with a high level of control over your finances, quick money transfers, and flexibility for all kinds of financial operations. Yet, it is often a more expensive and time-consuming option.

Aggregated merchant account: one in which the money your business generates is combined with that of other organizations, thus using a single account to provide payment processing for a portfolio of companies. In this case, you have limited control over your finances and withdrawing money may take longer.

3. Goods Sold

Another important consideration for those thinking about mobile app payment gateway integration is the types of goods you are selling.

We’ve briefly touched on this before, but it’s worth reminding that if you sell digital content like gaming or dating apps do, then you won’t be able to bypass App Store and Play Store’s policies for in-app purchases. In this case, you can’t use third-party services for payment processing and have to rely on the respective platforms which take 15-30% of the revenue.

However, if you’re selling physical goods or services that are accessible in the real world, mobile payment gateway providers are a great option for you. Even though you will probably have to pay transaction fees every time a sale goes through, they are still worth it, considering the benefits we’ve mentioned above.

4. Security Certificates

Since gateways process sensitive payment data like credit card numbers and personal information, you’ve got to ensure Payment Card Industry Data Security Standard (PCI-DSS) compliance.

Any company that deals with electronic transactions must adhere to PCI-DSS and the good news is — some payment gateways will make it easier to do so. However, abidance is still your responsibility, so whenever you implement a gateway double-check that everything is up to par. Or, turn to experienced development partners who can help you with the entire process and ensure all your security certificates are in order.

Uncover Top 5 Considerations for Choosing a Development Company

5. Transaction Fees

Lastly, all payment gateway service providers charge transaction fees. Hence, it’s worth looking into the one you’re interested in and comparing their price levels.

Generally speaking, the fees linger around 2.9% plus a minor fixed fee. Everything depends on the chosen provider, so don’t forget to consider the fees of each when making your decision.

Integrating the Right Payment Gateway

Figuring out which payment gateway integration is best for your mobile app or if you even need one can seem daunting. Yet, it’s an imperative part of ensuring profitability and long-term success of your solution.

At Velvetech, we value our clients’ time and are always eager to provide a consultation, carry out an integration, or develop a stellar mobile solution. So, don’t hesitate to reach out if you’ve got an idea for your next app and want to enlist some help or simply need experts to integrate a payment gateway into your existing tool. We’re happy to help!