The insurance industry has been undergoing change in recent years, and one IT trend that has been gaining traction is the use of telematics. In fact, research indicates that by 2030, the global insurance telematics market is likely to reach $13.78 billion.

Given the customers’ demand for personalization and policy pricing tailored to their unique circumstances, it’s no surprise that companies are after insurance software that can help achieve that.

So, today, we’ll dive into the subject of telematics in the insurance industry. Let’s explore what the term means, discuss the top use cases of the technology in the sphere, and look over the benefits it can offer. That way, you’ll be able to determine whether it’s something your business should leverage.

“Telematic devices help in improving premium pricing, enhancing customer perception of a company, and strengthening long-term relationships through closer communication.”

What Is Telematics in Insurance?

Although the term isn’t new, it’s important for us to have a clear understanding of it. So, let’s first answer the crucial question: what is telematics?

In essence, it refers to the use of smart devices to transfer, store, and obtain information about remote, insured objects over a secure network. Thus, allowing you to better determine the degree of risk associated with each customer, provide usage-based insurance coverage, and even gain insight into what may have caused a claim event.

Most often, telematics solutions are used in car insurance, however, they are also applicable to other subsectors of the industry. Overall, these tools allow insurers to provide highly personalized policy offers that are based on clients’ actions, as well as determine who might be at fault when an accident or other claim-related occurrence takes place.

Learn more about Hyper-Personalization in Insurance

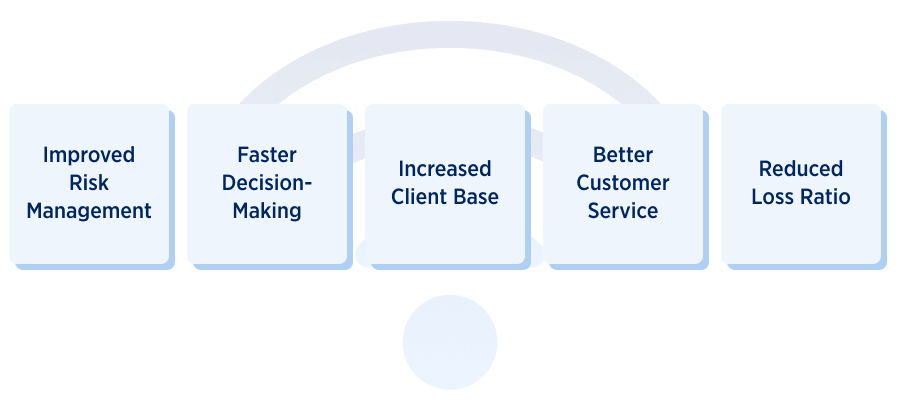

Benefits of Telematics

Before we discuss how telematics in the insurance industry works and speak about its top use cases, let’s go over the main benefits you might observe after implementing it into your business.

Improved Risk Management

Insurers constantly rely on thorough data analysis to determine the risk of offering coverage to a potential customer. The more accurate the forecast is, the less financial damage the insurer will experience.

As you can imagine, enhancing this type of analysis with reliable information from connected devices can provide a lot of insight into a policyholder’s risk profile. Thus, improving the underwriting process and reducing risks for the business.

Take a look at how we developed Underwriting and Onboarding Software

Moreover, with deeper insights into what had taken place before the filing of a claim, insurers can reduce the risk of covering damages for a fraudulent customer.

Faster Decision-Making

In the past, before making a final decision on coverage, insurance companies were stuck in a time-consuming process, digging through paperwork and checking all the details carefully. But now, telematics has made the claims process pretty fast.

Here’s how it works: Picture a situation where one of your clients has a car crash. After an accident happens, it is immediately detected by the device that provides crucial data about the overall conditions of the crash.

This gives insurers a solid picture of the incident, leading to not only accurate but also fast decision-making. Both sides win — clients receive swift claims processing, and insurers resolve issues promptly.

Increased Client Base

By supplementing your existing insurance offerings with telematics, you are empowered to deliver more customized coverages. Thus, attracting new customer segments that may be seeking to have more control over their premium pricing.

So, as you tailor the services you provide, more and more clients might flock to you and allow for the steady growth of a loyal client base.

Better Customer Service

Lack of flexibility and personalization can irritate clients and cause them to turn to your competitors. This can be avoided by implementing telematics-based solutions that allow for the customization of offers. By doing so, you’ll naturally cater to the desires of consumers and boost the quality of provided services.

Additionally, by speeding up claims processing, insurers can deliver a better experience to clients whose claims are honest and valid. Thus, leaving a positive impression and keeping them loyal to your organization.

Reduced Loss Ratio

The last but not least important benefit to gain from telematics is the reduced loss ratio. In particular, this becomes possible thanks to telematic devices’ ability to track some crucial data, thus minimizing incidents.

For example, if you offer auto insurance, you may employ tools (we’ll mention them shortly, so stick around) to analyze driving habits and generate reports. Knowing that their driving is monitored, people are more inclined to play it safe.

This may noticeably reduce incidents. Needless to say, the fewer accidents the customer has, the fewer claims insurers will handle. Therefore, cutting down on payout costs.

Insurance Telematics Use Cases

Now that we’ve established the advantages of telematics in insurance, it’s time to zero in on the particular use cases of this technology.

Auto Insurance Telematics

As previously mentioned, telematics is most commonly used in the car insurance sector. Specifically, the innovation helps personalize policy pricing for customers based on their driving-related behavior.

So, how does it work? Typically, telematics rely on GPS technology and other connected devices to monitor information that might be of value to insurance underwriters. For example, daily driving mileage, destinations visited, frequent hard braking, and other details that can speak to the riskiness of a particular client.

In general, you can utilize different telematic tools to collect data on driving habits and determine appropriate prices for each consumer. Here are the top three options to consider:

On-board diagnostics (OBD): These devices are installed in the client’s car and gather insights on driving habits.

Mobile apps: In this case, data is collected through the phone sensors. All the consumer needs to do is install the relevant mobile app.

Mobile Bluetooth tag: It’s a small device that is attached to a car and links wirelessly to a phone app via Bluetooth to monitor driving habits.

Once the data is collected, it is transferred to the insurance company for analysis so that the appropriate premium price can be determined for a customer.

Overall, there are two types of uses rising in popularity — usage-based car and pay-as-you-drive insurance. Both are sometimes used interchangeably, yet there are slight differences between them.

Usage-Based Car Insurance

This is an approach that’ll allow your company to assign a policy price according to a person’s driving behavior. In usage-based auto insurance, telematics data from cellular, GPS, and other devices is collected and analyzed to predict the likelihood of future claims.

Read up on the Role of Predictive Analytics in Insurance

Specifically, the following factors can be monitored:

- Driving speed

- Hard braking

- Acceleration

- Driving distance

- Hard cornering

- Typical time of day for driving

As you can imagine, having access to these unique details expands the company’s understanding of a particular client. By pairing the collected data with artificial intelligence technology and machine learning algorithms, you’ll be able to quickly determine the most optimal premium price to assign.

Discover more about AI in Business

Pay-as-You-Drive Insurance

This auto insurance type became more in demand due to the pandemic. As people were stuck at home and not using their vehicles as often, insurance seemed like an unnecessary additional cost. So, a pay-as-you-drive program became a potential solution.

This approach implies precisely what the name suggests. The more the customer drives the car — the more they’ve got to pay for coverage. Of course, other factors like driving history and past claims also have to be considered when identifying the right policy price in this case.

Pay-as-you-drive can be particularly appealing to those who use their vehicles rarely. So, by adding this to your offer before competitors, you might start attracting a new customer segment and boosting revenue.

Telematics for Supply Chain Insurance

In modern realities, businesses rely extensively on overseas suppliers, cross-continental transportation, and warehousing facilities spread across multiple cities. These elements of the global supply chain play an important role in ensuring timely and safe delivery of materials and finished products.

Naturally, delays, destructions, and losses might occur. Thus, organizations that deal with the supply chain often purchase specialty insurance policies that can reduce the risk of losing valuable inventory during transportation or storage.

In this context, telematics can also offer help to insurers and business clients alike. Primarily, by using sensors to track information about the driver, the vehicle, and product storage conditions. Moreover, when connected devices detect accidents, the interested parties gain alerts so they can take appropriate measures immediately.

Also, insurers use telematics to assess a transportation company’s risk by looking at whether the firm uses data from connected devices for fleet management and hazard mitigation. This is a similar practice to the above-described use in auto insurance but simply with a focus on commercial vehicles and organizations.

Another way to add value to supply chain insurance is by monitoring the conditions in which the goods are being transported. After all, even if the products are delivered on schedule but were stored in inadequate temperatures — they can be unusable and thus result in losses for the manufacturer. So, having reliable data to establish whether the transportation company was at fault or not can be crucial.

Read up on how we Developed a Cold Chain Monitoring Solution

Telematics in Home Insurance

This technology can also be of high interest for those within the home insurance. After all, if you can obtain reliable data about what’s going on within the house you are set to insure, the underwriting process might get a lot easier.

Here, intelligent home appliances are key, as they can transmit information about how well the home is maintained by, for example, monitoring the state of electrical equipment. If it is evident that a customer frequently replaces worn-out HVAC systems or keeps the stove in top-notch shape, he might be a good candidate for a lower premium price.

Moreover, besides keeping track of how hazard-free a home might be, the system can also alert homeowners and insurers when it’s time to conduct some kind of maintenance. Thus, naturally reducing the likelihood of insurance events and subsequent filing of claims.

It’s also worth mentioning the role of telematics in insuring commercial property against fire, theft, or natural disasters. Manufacturing companies, retailers, and plenty of other organizations that own commercial real estate may want to insure it to reduce risks.

The role of telematics is similar here. The technology can continuously collect data on the state of fire alarm systems, water leak detection tools, and other devices that relate to the safety of the commercial property. Thus, informing insurers of how risky it is to cover a specific estate while simultaneously helping prevent claim events through real-time alerts.

Telematics for Health and Life Insurance

Within healthcare, there’s plenty of potential for this innovation as well. Particularly, thanks to the growth of the Internet of Medical Things (IoMT).

As an insurer, you’re interested in identifying customers that are the most likely to obtain costly medical services and make use of your insurance coverage. That is precisely what dictates a policy price your underwriters will assign to each specific individual.

With telematics-based health and life insurance, a lot of guesswork can be eliminated. By collecting data from wearables, hearables, or even ingestibles, you can better understand a person’s activity levels, among other things. As a result, you can better gauge how risky it is for your company to insure him or her.

Find out how Velvetech built Remote Patient Monitoring Software for Urology

Barriers for Telematics Implementation

Now you know about the most popular types of telematics insurance, but before you dive into the implementation phase, we ought to discuss some barriers you may face.

Data Analysis

Telematics in and of itself mainly helps obtain and store information about remote objects. The telematics tool that is installed somewhere doesn’t analyze the collected data. As such, you need to make sure that the implementation of this technology goes hand in hand with software for thorough data analysis.

Large amounts of data need to be gathered and analyzed quickly. That’s the only way to truly reap the rewards. So, don’t look at it as a “cure-all”. Rather, remember to also acquire intelligent BI tools and data science solutions that can take the data you’ve collected and transform it into valuable insights.

Discover how we Automated Data Processing for an Insurance Company

Privacy and Security

As you gather more and more data, the risk of cyberattacks and data leaks grows. Your organization becomes a potential target for hackers. Thus, it’s important to ensure there are strict and thorough data privacy policies and security measures in place before you begin offering telematics-based coverage.

After all, if you can’t guarantee a high level of personal data safety to your customers, it’s unlikely that they’ll choose to share information with you. Even if it might reduce the pricing of their policy.

Read up on how Velvetech Protected Clinics from Security Breaches

Add Telematics to Your Insurance Offer

Telematics is most popular within the auto insurance sector, but that doesn’t mean that there isn’t ample potential for this technology within other areas too. So, regardless of the space you operate in, these intelligent insurance telematics solutions might be the right next step in your company’s growth.

At Velvetech, we understand that it can be challenging to figure out which IT project to pursue next and to find the right specialists for its execution. That is why we’ve assembled a wide range of insurance software development services that can help on your technological implementation journey.

So, don’t hesitate to reach out to our team and schedule a consultation. We are always eager to discuss a potential collaboration and will get back to your query as soon as possible.