The fintech sector saw an explosion of growth over the past few years. As we continue to see a closer tie between financial and technology companies, we want to explore the largest fintech software development sectors.

Why does it matter? If we understand the top sectors, we can follow the trends to see how the industry develops over the next few years and affects your company.

What are the Top 11 FinTech Software Development Sectors?

#1. Payment & Billing Software

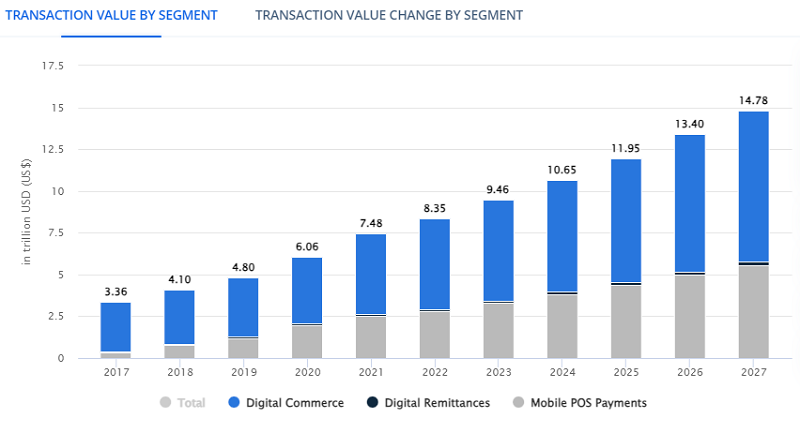

The total transaction value in the digital payment market is predicted to expand at an annual pace of 11.80% (CAGR 2023-2027), hitting USD 14.78 trillion by 2027. In recent years, this segment has experienced significant growth, which was further influenced by the pandemic. The increased demand for contactless services led to more customers preferring them.

With extensive expertise in multiple fintech domains, Velvetech stands out as a full-service provider for financial firms seeking to embrace digital technologies, optimize their payments and billing operations, and enhance performance through workflow automation tools.

A good example is tracking the age of missed payments. If a payment is a day or two late, then it is probably an honest mistake. The payee needs a simple reminder to pay their bill.

Conversely, those who are 90-plus days late will probably not pay. It is an entirely different scenario with different collection efforts. Routing this through a workflow can automate the customer-facing functions as well as what the back-office operations need to collect payments at specific points in the process.

Our experience with payment and billing can help you create a software tool that collects monies based on your requirements.

#2. Digital Banking

Due to the growth of mobile technology, face & voice biometrics, blockchain, and AI over the last few years, we might be able to do all our banking in the next few years in the comfort of our pajamas.

Some banks like Ally, Atom, GoBank, and even the military bank USAA have gone entirely digital. While this reduces your overhead, a digital bank faces challenges that a physical bank like Bank of America or Chase might not encounter.

For example, how do you know you are giving money or account access to the right person? To solve these issues fintech relies on features like face and voice biometrics.

The final challenge is how you know what to do when you don’t have a human helping you with your banking. That is where the chatbots and AI features help.

Even if you are not ready to go 100% into digital banking, Velvetech has the expertise and dedicated team to assist you in smoothly migrating a significant portion of your processes to mobile and digital software solutions.

Discover how AI Can Transform Finance and Banking

#3. P2P Lending

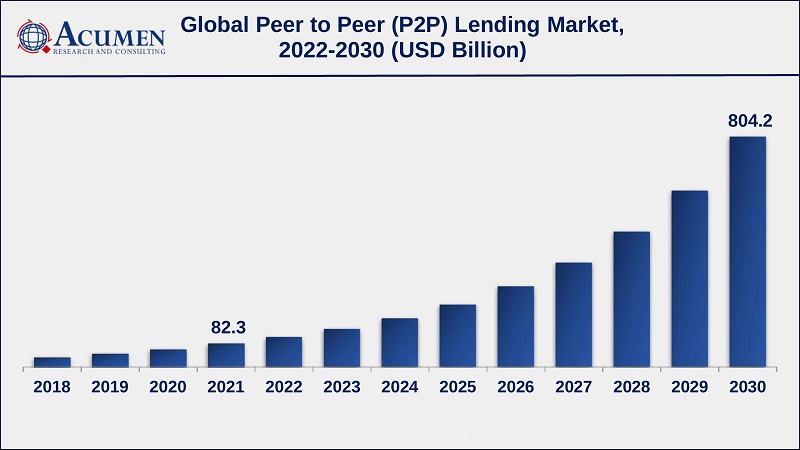

Decades ago, the P2P lending space was in its nascency. Only one or two companies like Prosper and Lending Club existed. Now, the idea has taken hold. In fact, the P2P lending market revenue is estimated to reach USD 804.2 Billion by 2030.

As consumers and businesses look for alternative funding sources to banks, the best option is to work with these P2P alternatives.

However, these microloans require a lot of machine learning, intelligent algorithms, and AI technology to underwrite the loans.

Velvetech leverages the latest P2P technologies to provide comprehensive lending software platforms that facilitate efficient and secure transactions, empowering borrowers and lenders alike.

#4. Crowdfunding

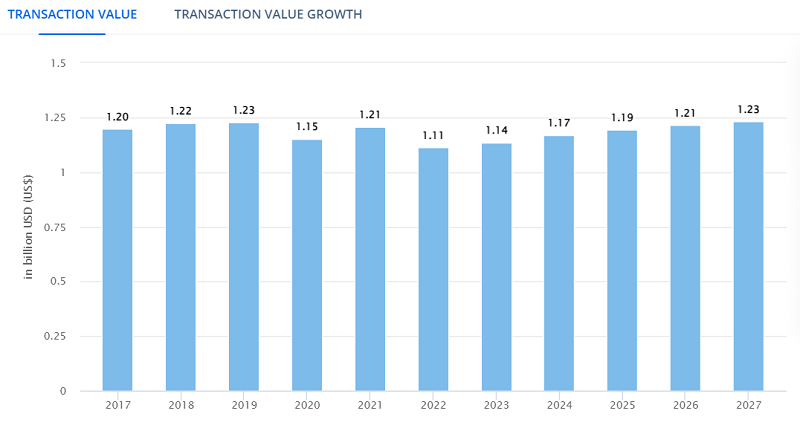

Crowdfunding is the cousin to P2P lending. This fintech vertical is still on the rise. According to Statista, transaction value in this market is projected to reach USD 1.23bn by 2027.

There are three main types of crowdfunding it is worth considering.

- The first is for people who invest in a new product or idea because they want the product. Often sites like Kickstarter show you the latest gizmos and gadgets when they first launch.

- Second, charities use crowdfunding to support their cause.

- Third, some crowdfunding sites give investors a small piece of equity in a new startup looking to raise funds.

With multiple people involved in every transaction, the technology needs to track all parties involved. Crowdfunding sites use machine learning databases and payment integration technologies to achieve this.

#5. Investment

It almost seems pre-historic now, but traditionally if you wanted to trade a stock, only a broker could order a stock certificate. The physical stock certificate exchanged hands on the trading floor where the broker bought your stock.

How the world has changed! Today, investors have the power to take control of their investments with the aid of sophisticated investment management software. Now, you can do quick and easy trades on your mobile device without any human assistance in less than a minute. The right technology can help you make the right investments.

Mobile technology is only part of the equation. For instance, today investors actively use AI and machine learning technologies to help them make profitable investments.

See how Velvetech worked on an Intelligent Trading Platform

#6. Financial Management Platforms

Over the past few years, change struck the financial management industry.

First, many product commissions were eliminated. Previous prime earning scenarios went away.

Second, the government started enforcing a harsher version of the Investment Company Act of 1940 that requires Registered Investment Advisors (RIA) to put their client’s interests first irrespective of all other factors.

Third, the 1% fee most advisors now charge might become a thing of the past. For clients with more substantial amounts, it is not worth it to pay someone $10,000 on a $1 Million account every year for advice.

That is why fintech stepped in to fill the gap. Sites like Betterment use a series of algorithms to determine the best course of action for your investments at a fraction of the fees.

Just like AI and machine learning help investors, they help financial management platforms identify and verify top investments based on your criteria and goals.

#7. Insurtech

The insurance technology subsector within the fintech is also witnessing rapid growth.

Insurtech combines mobile solutions, Big Data, IoT, AI software tools, and a mix of algorithms to help insurance companies manage risks, increase sales, and improve their returns.

Some Insurtech companies like BIMA provide health insurance services to consumers through their mobile devices. The data collected from users’ devices help them track information, and then the data gets used to create innovative products based on client needs.

See how Velvetech delivered Innovative Solutions to a Small-Business Insurance Company

#8. RegTech

Regulations and compliance are essential sectors of fintech. Regulatory Technology (RegTech) aims to help financial institutions comply with legal requirements.

RegTech automates compliance processes by leveraging technologies like ML and data analytics. This, in its turn, leads to risk management automation, real-time compliance reporting, and more.

Some common and well-known regulatory compliances that are worth considering when developing FinTech software are Know Your Customers (KYC) and Anti-Money Laundering (AML). They help verify customers’ identities and detect and prevent money laundering activities.

RegTech also employs strong data security and privacy protections to safeguard sensitive information and ensure compliance with data protection standards such as the General Data Protection Regulation (GDPR).

#9. Blockchain and Cryptocurrency

Today the areas of fintech encompass a wide range of financial services. Revolutionary technologies like blockchain and cryptocurrencies have transformed the development of financial software, presenting a multitude of exciting opportunities. Let’s explore some of them in more detail.

- Better Transparency and Faster Transactions. Blockchain provides a decentralized approach to transaction recording. It leads to transparency and security, as there is no need for intermediaries to facilitate and validate payments. Furthermore, because blockchain does not require third parties for verification, it promotes faster transactions.

- Identity Verification. Blockchain technology has the potential to improve identity verification processes. By storing encrypted identity information on a blockchain, it is possible to create more secure and efficient systems for user identification. Additionally, it can reduce identity theft and fraud issues.

- Cross-Border Payments. Unlike traditional payment systems, cryptocurrencies enable fast and low-cost cross-border transactions. So, there is no need to involve multiple intermediaries and lengthy settlement periods. Overall, it brings faster and more cost-effective transfers.

Find out How Blockchain Transforms Financial Industry

#10. Financial Education and Literacy

In the fintech segment, financial education and literacy play a crucial role. Obviously, users should have a solid understanding of financial concepts and opportunities, to make informed decisions or fully utilize the software features.

Hence, implementing EdTech into financial software can enhance user empowerment. As a result, they will gain basic knowledge of financial principles, budgeting, investment strategies, and other relevant topics.

This approach will also improve user experience. Understanding financial software features will help users make the most of its functionalities.

#11. Financial Data Analytics

The last but not the least Fintech subsector we want to cover is financial data analytics. In short, it’s a process of collecting, organizing, and analyzing financial data to generate valuable insights. Typically, businesses utilize data analytics services to define their current financial status and point out areas of improvement.

Today, technologies like artificial intelligence and machine learning propel data analytics forward. They process and evaluate large amounts of information at a remarkable speed.

Additionally, AI and ML provide real-time data processing, allowing financial institutions to react quickly to market changes and make timely decisions.

Overall, thoroughly planned data management strategy and BI technologies significantly improve organizational performance and efficiency. Businesses gain the ability to identify and understand trends, patterns, and customer preferences. This valuable information enables them to adapt their products and services to align with the ever-changing market demands.

Final Thoughts

With the explosive growth of the fintech market, we have witnessed the emergence of early innovators in the field. Moving forward, we can expect a continuous stream of new ideas from companies that leverage the fusion of finance and technology to enhance people’s lives and the fintech domain in general.

Velvetech is ready to help you merge both sides into a better solution for your customers and employees. If you need help with your next fintech project, contact us today.