In recent years, AI has been protruding into a multitude of industries, and the financial sector was certainly not left behind. Today, financial institutions are heavily investing in this technology.

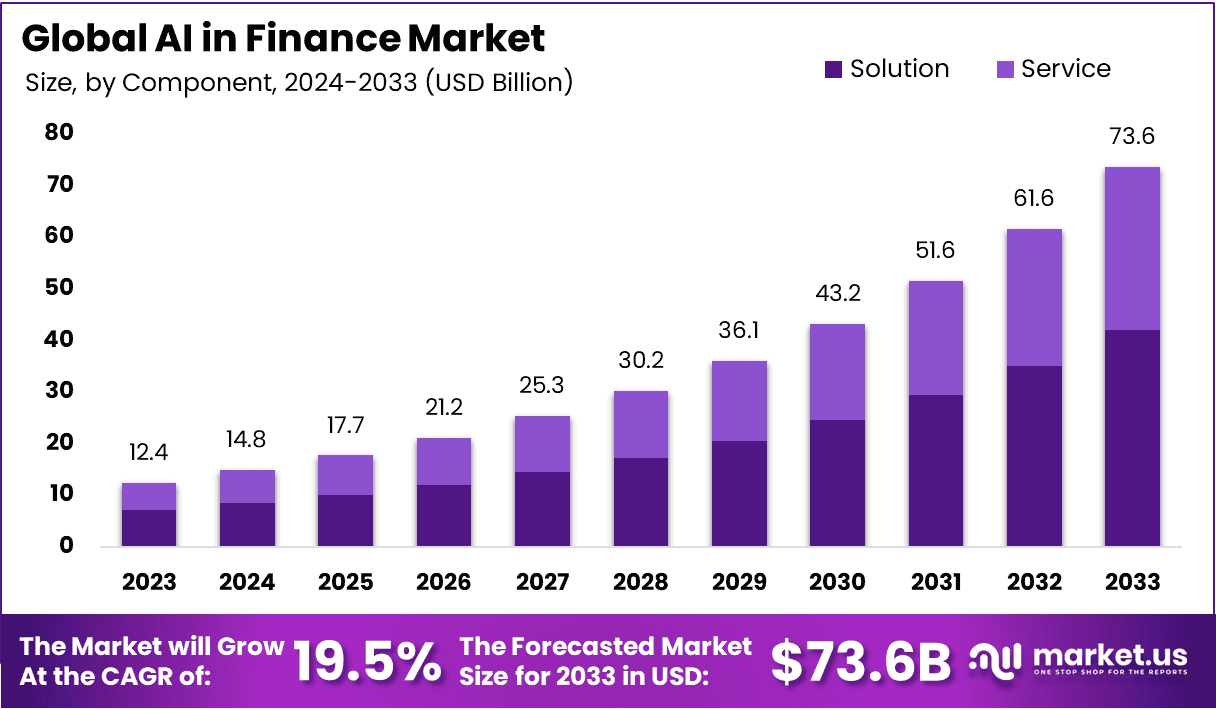

Incidentally, the global AI in the fintech market has been doing so well that it is projected to reach $73.9 billion by 2033. That’s an impressive CAGR of 19.5% since, in 2023, the market had generated a revenue of $12.4 billion.

With so much growth and potential, it’s more important than ever for business leaders to understand how AI can be applied in the financial services industry. So, that’s precisely what we’re going to talk about today.

Key Highlights

- AI-powered software processes insights, helping businesses deliver a unique experience to every customer.

- AI-based contact centers assist sales and customer service agents to guide dialogues in the right direction and automatically adjust the next best response.

- To provide insights, AI algorithms rely on the data used to train them. Even a small mistake or bias can compromise the reputation and trustworthiness of your company.

- Building a robust AI-powered fintech solution requires an experienced team, which can be neither simple to find nor inexpensive.

The Role of AI in Finance

To understand intelligence tools, we first need to address what AI is and how it helps your organization.

AI merges machine learning, natural language processing, deep learning, and predictive analysis. All in all, it uses computer algorithms to mimic human actions.

Basic types of AI have been around for a few years. Amazon’s product recommendations that use machine learning to improve upsells and cross-sells are a great example.

However, because of advances in technology, product recommendations are just the beginning. In recent years, a couple of factors have positively contributed to the adoption of AI in the financial sector. So much so that some companies are already busy implementing these solutions to improve business performance. Stick around, and we’ll soon skim through the core driving forces.

But before that, let’s quickly sum up the essence of AI in finance. It’s about using smart technologies like ML, NLP, deep learning, GenAI, and the like to streamline a variety of financial tasks, from data analytics to fraud detection and personalized offerings.

GenAI for Business

Watch our webinar to uncover how to integrate GenAI for improved productivity and decisions.

AI in Finance Adoption Drivers

An innovative paradigm shift has significantly changed all industries over the past decades. And the financial sector had no choice but to adapt as well. So now, as promised, let’s zoom in on the core factors that contributed to AI implementation in the financial sector.

- Big Data. The enormous increase in the amount of data that is being generated within the financial services sector has peaked the interest of organizations. Now, they are eager to leverage big data for a better understanding of customer behavior and the delivery of more personalized services.

- High Competition. Competition is getting stiffer every year. Naturally, this makes banks, insurance companies, brokerage firms, and other financial institutions eager to find new ways of differentiation.

- Regulatory Obligations. Financial institutions tend to be under a high level of scrutiny from regulators. After all, any inquiries must be answered promptly and the requested reports provided without accidental mistakes. Thus, organizations are looking for ways to speed up and systematize internal processes to ease regulatory compliance.

Of course, the above-mentioned factors are non-exhaustive. After all, every business is different and has varying priorities that drive digital transformation. However, no matter what your unique case is, chances are high that you can benefit from the development of AI applications.

Top Uses of AI in Finance

We’ve already seen how financial organizations are being disrupted by various technologies. Predictive analytics is a game-changer for insurance, blockchain is revolutionizing banking, and these are just a few recent examples.

Today, we’re focusing on yet another innovation that’s transforming finance — artificial intelligence. So, in this section, we will take a closer look at the top AI use cases within the industry.

1. Personalized Banking

In recent years, with the number of options growing, customers have become more selective than ever with their banking choices. Now, if you can’t deliver a smooth and efficient service that goes beyond providing the basic financial necessities, clients might quickly flock to competitors. With AI, this can be avoided.

You see, thanks to AI’s ability to comb through large amounts of data in seconds, it can be an invaluable technology for banking and finance applications. Specifically, intelligent systems can keep track and regularly analyze customer income, expenses, spending habits, and disclosed financial goals.

Then, AI-powered software uses the gathered insights to provide personalized financial advice and recommend investments or related services to those that may be interested. Thus, helping you deliver a unique experience to each and every customer.

2. Intelligent Customer Relationship Management

As we’ve already established, personalization is important because it helps financial organizations deliver better customer experiences. However, that’s not the only thing that can improve your relationship with clients. AI-powered CRM platforms, contact centers, and even chatbots can all prove invaluable in boosting the quality of the services you offer.

CRM Platforms

Financial institutions use data from the first contact to ongoing services for current customers. With an intelligent CRM solution, you can leverage the gathered digital information to tailor a personalized experience for each customer and streamline entire sales operations.

Discover how a CRM Improves Lead Generation

For instance, if you implement a platform like the Creatio CRM that combines big data and advanced technology to improve your contacts management process, you’ll quickly observe more deal closures and happier sales agents.

This happens because an intelligent solution like that has a robust set of features for helping you achieve your goals. Specifically, Creatio comes with the following AI-enabled functions:

- Lead scoring to identify and prioritize high-value candidates.

- Lead routing to connect the right opportunity to the right sales agent.

- Personalized nurturing campaigns to study customer behaviors and create relevant, automated communication.

- Predictive analytics to provide agents with recommendations on the steps to take to generate the most revenue.

- Sales forecasting to foresee quarterly or annual results based on historical and pipeline data so that adjustments can be made if needed.

- Operations optimization to identify where and when certain staff members will be required.

- Data enrichment for acquiring relevant information from different channels and creating a more effective sales pitch.

So, if you’re looking to give your sales and marketing operations a significant boost, definitely consider implementing an intelligent CRM solution that will take most of the hard work off your hands.

Find out how we implemented a CRM for a FinTech Company

Contact Centers

Another important area of customer relationship management that AI can improve is definitely contact center performance. Since the flow of conversation is often hard to predict, agents may struggle leading the discussion towards a fruitful conclusion.

However, with AI-based contact centers, financial companies can ease the work of sales and customer service agents by providing them with real-time conversational intelligence and call analytics. Specifically, intelligent platforms deliver real-time suggestions that guide the dialogue and automatically adjust what is the next best thing to say.

As you can imagine, this can help your staff feel more confident throughout the discussion. Thus, leading to more closed deals, faster resolving of customer issues, and a better experience for everyone involved.

Read up on AI Call Analytics Boosting Insurance Sales

AI-Based Contact Center Product Suite

Full-featured Inbound & Outbound call center with AI-based agent scoring and call analytics.

Automated Chatbots

Great customer support is of utmost importance in any business. However, it’s particularly imperative in finance, where people are dealing with money, and tensions can quickly rise. So, unless you’ve got a team working 24/7 to respond to queries, conversational AI tools like an automated chatbot can be a good tool to employ.

By relying on natural language processing, chatbots can quickly decipher a received question, find the optimal answer, and deliver an accurate response that the client is looking for. Thus, allowing you to reduce operational expenses while still catering to customer needs and providing an excellent level of service.

3. Predictive Credit Risk Assessment

Another one of the major AI uses in financial services is definitely within credit decision-making. As you know, determining the creditworthiness of a borrower can be a time-consuming task, especially when you’re dealing with a brand new client. However, it’s imperative for financial institutions to accurately identify high-risk customers so that unnecessary issues and losses can be avoided.

Here, AI can come in and quickly analyze a myriad of factors that impact a person’s ability to pay back what they’ve borrowed. Moreover, AI-powered lending software typically uses more elaborate credit scoring approaches than traditional platforms. For instance, it can seamlessly distinguish between a high-risk applicant and someone who just doesn’t have enough credit history but might otherwise be reliable.

For these reasons, more and more financial organizations are relying on AI to carry out credit risk assessments and optimize their lending processes.

Want to Explore More Opportunities Predictive Analytics Offers to Finance?

4. Seamless Mortgage Automation

Though it might seem like once a risk assessment is done and the client is trustworthy, they can get credit right away, it’s not that simple. Next up, mortgage processing and underwriting come into play. This part tends to be one of the most time-consuming and toughest, because of the huge amount of paperwork that needs to be handled.

From this perspective, AI becomes a precious asset for the banking industry. Specifically, AI copilots can assist in automating tasks like verifying income documents, analyzing tax returns, checking property appraisals, and ensuring the loan adheres to regulatory compliance. Additionally, it’s possible to cross-check information across different documents to catch any inconsistencies.

Discover more use cases of AI Compilot in Finance

Plus, automation keeps the client updated throughout the whole process. Needless to say, this significantly speeds up mortgage and underwriting workflows, boosting customer satisfaction and helping banks reduce processing costs and improve accuracy.

Given that today it’s possible to automate plenty of financial tasks thanks to AI, from underwriting to fraud detection, it may seem that, in the future, AI will replace financial professionals. However, automation is simply a tool to reduce manual, time-consuming, and error-prone processes. The financial sector will definitely require strategic thinking and skilled professionals to drive real value for their business.

5. Smart Debt Management and Collection

Even when all the risk assessments are done and the loan is approved, financial institutions can’t let their guard down just yet. They still need to ensure smooth debt management.

One of the best ways to get there is by utilizing another prominent application of AI in banking — debt collection. Thanks to this innovation, it’s possible to:

- Improve cash flow predictability

- Identify high-risk accounts early

- Craft tailored repayment plans

- Automatically send personalized payment reminders

- Ensure compliance with debt recovery regulations

And these are just a few vivid examples of what you will gain by employing AI-powered debt collection solutions.

6. Data-Driven Investment Management

In investments, information is everything. Yet, analyzing it isn’t usually the quickest process. After all, there are many factors that go into determining whether something is a worthy investment or not.

As you may suspect, AI has a part to play in this area of finance as well. First, thanks to ML algorithms, all the structured and unstructured data that’s needed for investment decision-making can be analyzed at a much faster speed than a human is capable of. Thus, allowing you to capitalize on more opportunities within a shorter time frame.

Moreover, besides partially automating the decision-making process, recommendations provided by AI-powered investment management software tend to drive better results. This occurs due to the algorithm’s ability to go through historical data and leverage predictive analytics to forecast, with a high degree of accuracy, potential profits from an investment and its impact on your portfolio.

7. Algorithmic Trading

“Seconds can make or break a deal.” This wisdom is definitely true for the trading industry. A missed second here can cost you dearly. And given the vulnerability of this niche and market volatility, manual efforts can’t work wonders.

Instead, algorithmic trading does the job best. There’s no need to endlessly refresh trading platforms to catch the moment for a profitable trade. You simply set your current instructions, like buy an asset when it drops under a certain price, or sell when it rises, and the algorithm automatically does the rest.

Discover how we helped Improve an Intelligent Trading Platform

8. AI-Enabled Security and Fraud Prevention

An industry that deals with as much sensitive information as finance, data security and fraud prevention are of utmost importance. However, with so many payments and transactions getting carried out daily, it’s easy for issues to fall through the cracks.

Once again, AI can come to the rescue. It can detect any suspicious activity and send alerts in order for your staff to check it out. Previously overlooked transactional patterns, anomalies, and suspicious relationships can be detected, and any fraudulent activities prevented. Thus, allowing for a more proactive approach when it comes to avoiding deceptive behaviors.

Additionally, since AI can learn from experience, it continuously improves its understanding of cybersecurity threats and detects potential breaches faster to prevent them altogether. Malicious files, suspicious IP addresses, and other items that may pose a cybersecurity risk are quickly eliminated before any lasting damage occurs. Thus, boosting your company’s data safety and reducing the likelihood of any financial losses.

Maintaining strong data protection requires more than automated monitoring — periodic system reviews and expert cybersecurity consulting can help ensure your defense mechanisms evolve along with new types of threats.

9. Advanced Financial Planning and Analysis

Aiming to remain competitive and economically healthy, financial companies should thoroughly and carefully evaluate their business performance and assess factors that may have an undesirable impact on their operations. That is to say, they need a robust financial analysis.

This would be hardly achievable without AI technologies. Here, ML does the heavy lifting. It smoothly processes massive volumes of data from different departments and helps predict possible outcomes.

NLP, on the other hand, streamlines reporting based on the insights provided by ML. It generates reports in a more human-like and easy-to-understand format. This, undoubtedly, empowers the analytical team to utilize data more effectively and improve strategic planning.

10. AI-Powered Trends and News Analysis

Markets are highly affected by everything that’s going on in the world. Hence, pretty much any piece of news can send a stock plunging or, on the contrary, boost its value. Eventually, by monitoring enough of such occurrences, one can identify patterns and emerging trends. Of course, that’s a time-consuming process.

AI applications, however, can leverage natural language processing to go through news, perform sentiment analysis, and quickly determine the impact a particular article will have on the world of finance. Thus, empowering your organization with almost immediate insights on how markets or any other financial areas are going to be affected and giving you time to prepare.

AI-driven technologies redefine the way the financial industry operates. Here are the most prominent use cases of AI in financial services:

• Personalized financial offerings

• Automation of error-prone and time-consuming tasks (e.g., data entry, invoice processing, underwriting)

• Round-the-clock customer support and intelligent contact centers

• High accuracy of credit risk assessment

• Streamlined debt collection

• Robust investment management and trading

• Security and fraud prevention

• Advanced financial planning and analysis

• In-depth trends and news analysis

Key Obstacles to Artificial Intelligence Implementation

Now that we’ve covered the main uses and benefits of AI in finance and banking, it’s time to look at the challenges that may obstruct seamless development. Unfortunately, given the relative novelty of the technology, there are a couple of obstacles you might encounter.

Data Silos

Data silos are individual repositories of digital information that are typically controlled by one department and are thus isolated from the rest of the company. As you can imagine, this is a problem for AI models that require as much relevant data as possible to perform at the highest level of accuracy.

Therefore, it’s important to consolidate digital information prior to starting AI development. That way, you’ll acquire a truly helpful AI system that makes use of the best data science practices to deliver results.

Learn more about Enterprise Data Science

Data Protection

Another major AI implementation challenge in finance and banking is data protection. Since financial institutions deal with large amounts of sensitive information, your organization must have good security measures to ensure data safety. After all, you wouldn’t want to lose valuable customers because of breaches that could’ve been avoided.

Limited Trust in Algorithms

For someone who doesn’t work with artificial intelligence directly, it can be hard to understand what actually goes on in the “black box” of an AI solution.

Are the algorithms extracting accurate insights? Can the algorithm be biased? How can I trust that what the software is suggesting is good? All these questions may lead your employees to doubt the performance of your tool and hence avoid using it. So, make sure you educate your staff and answer any questions they may have before implementing AI into their workflows.

Additionally, be careful about the data you use to train your algorithm. As such, you can minimize the risk of bias and improve the accuracy of predictions.

High Implementation and Maintenance Costs

AI can be a treasure trove for the financial industry, unlocking new opportunities across banking, insurance, investment management, and other related services. However, implementing this innovation can make your wallet feel it.

Even if you’re ready to invest heavily in adopting this technology, keep in mind that future maintenance costs can also be pretty high. So, plan your budget carefully in advance to avoid getting stuck halfway through.

Talent Shortage

Lastly, limited access to skilled talent can be a major obstacle to successful AI implementation. At the end of the day, you need skilled and experienced specialists to help build your solution.

Unfortunately, they may simply not be available at your location or be too expensive to hire internally.

Hence, it might be worth considering outsourcing software development so that you can avoid wasting time and money on the talent search and get right down to work with a professional team.

Lack of Developers

Find out how to deal with the lack of IT talents without compromising project delivery.

The Future of AI in Banking and Finance

The financial services we see today are completely different from those we used to deal with decades ago. A significant part of these changes would be impossible without AI. Moreover, this innovation won’t rest on its laurels and will continue to redefine this sector.

Overall, we can expect significant advancements in all the areas we’ve touched upon today. Before wrapping up, let’s briefly highlight what to expect in upcoming years:

-

More personalized offerings: Banks will be under fierce competition to provide hyperpersonalized customer experiences and gain a competitive edge.

-

Reduced algorithmic bias: AI algorithms will become smarter and more capable of making fair and transparent decisions.

-

Automated and adaptive compliance: AI will increasingly enable proactive, real-time monitoring of regulatory compliance and help financial institutions automatically adapt to evolving regulations.

-

Always-on AI crawlers: By scanning various real-time sources like social media, financial news, and other industry platforms, AI crawlers can help detect potential risks early, as well as identify opportunities, leading to business-driven decisions.

AI will continue to create value for finance in the future. Specifically, AI-driven technologies will elevate hyperpersonalization of financial services, improve compliance efforts, and integrate always-on AI crawlers to enhance decision-making. Plus, AI algorithms will become smarter, leading to more transparent and unbiased decisions.

Develop Intelligent Software for Your Financial Institution

Financial organizations are undergoing change. More and more companies are embracing digital transformation, implementing new fintech software solutions, and leveraging technologies like AI to drive business growth.

As we’ve seen today, artificial intelligence can deliver a variety of benefits to the finance industry. Largely, thanks to its capacity to process large volumes of data and derive meaningful insights from it.

However, AI implementation doesn’t come without its challenges, and not every company might be prepared to deal with them. Hence, at Velvetech, we are proud to offer extensive AI software development services to help empower financial institutions with any kind of intelligent tools they may seek.

So, don’t hesitate to reach out to our team to discuss a potential collaboration. We’re always happy to dive into a new, innovative project.

Want to learn more about how we can collaborate? Contact us.