Mobile technology has changed the way people go about their everyday activities. Today, we will shine a light on mobile insurance apps in particular, so that you can understand whether they’re something your business needs.

- Types of Insurance Mobile Apps

- Pros of Customer-Facing Applications

- Benefits of Employee-Facing Applications

- Core Features to Include in Your Solution

- When To Avoid Investing in Insurance Apps

- Key Steps to Build an Efficient Insurance App

- Get Started With Insurance App Development

It’s getting harder to find those who don’t use digital devices on a daily basis. In fact, U.S. adults are spending more and more time on their portables, reaching an average of 280 minutes per day.

No wonder custom insurance mobile app development is gaining popularity. The market is expected to reach around USD 26.7 billion by 2032. So, it seems like it’s a good time to consider building a mobile application for insurance.

Choosing a Winning App Development Strategy

Watch our webinar to uncover effective mobile development approaches and launch your app.

Insurance Mobile App Types

The insurance business revolves around many parties: an insurer, reinsurer, insurance agents and brokers, affiliate partners, and last but not least — customers. All these parties have their interests and stakes, and from here we can identify two major types of mobile insurance solutions:

- Customer-facing insurance apps

- Insurance employee-facing apps

However, we can add another type of insurance app that you also might be interested in delivering to the market — the aggregators. It stands out from the two categories, yet it provides value for both sides of the equation: the parties that offer insurance services and the insured.

Let’s discuss how all these types of mobile insurance solutions create new opportunities.

1. Mobile Insurance for Customers

We have come to rely on apps for the ease of use, availability, and interactive features they offer. This functionality is exactly what your customers will be looking for in your mobile insurance solution. Let’s take a look at the feature set that insurance companies can pack into an application.

Claim Submission

The convenience of reporting a claim from anywhere and at any time can be hardly overestimated. When all it takes to submit a request is to snap a photo and add some description or record an audio message right at the site of an accident and send these details to the insurer via an app, the need to deal with an insurance company suddenly doesn’t seem so scary anymore.

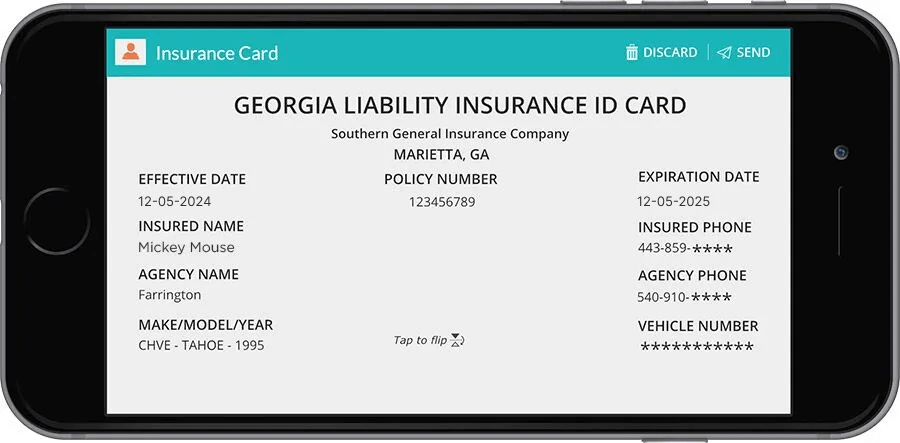

Policy Management

An obvious functionality in an insurance app is the ability to manage insurance policies. Things like coverage details, a policy number, due premiums, and an option to prolong a policy seem like a safe bet for including into an insurance app.

Read more about Key Features of Insurance Policy Management Software

Chatbots

Customers who are just browsing your app to find an appropriate insurance product for their needs will appreciate an interactive chatbot that can offer personalized advice.

Based on the customer’s app browsing history, location, and other parameters, a chatbot module can help the customer purchase the right insurance product, or it can hand off the conversation to an insurance agent.

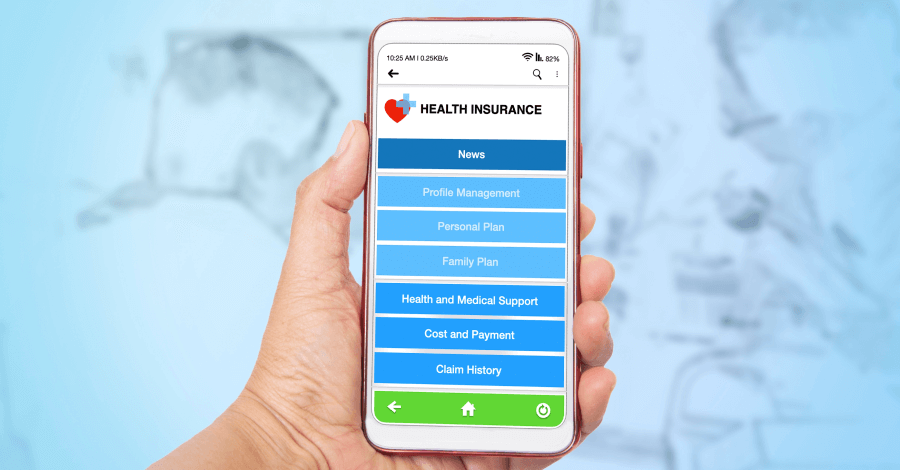

Industry News and Guides

Another feature that can help your insurance brand stand out among other mobile insurance solutions is publishing news and step-by-step guides for your app users. The customer might need directions in case of an accident to make the right decisions and provide the necessary materials, such as photos, in an emergency situation.

Push notifications, in turn, with news about your company or the insurance industry will keep your customers loyal and may help you grow profits by offering add-on insurance products.

Payments

According to Seamless Chex, mobile payments will account for 79% of all digital transactions by 2025. So it’s only natural to enable premium payments via an app.

Your insurance customers will be able to add a credit card to the app and make recurring payments. The biometric authorization methods offered by modern mobile devices will ensure the security of this sensitive data.

These features cover only tip-of-the-iceberg functionality that you can implement into your mobile insurance products for better user engagement and loyalty.

2. Mobile Insurance for Employees

Apart from customer-facing apps, many companies can also benefit from deploying mobile insurance solutions for internal usage by their employees. Let’s take a look at tasks such apps may solve for an insurance business.

Mobile CRM Solutions

Policies and other add-on insurance products don’t sell by themselves. Therefore developing a CRM app can help push sales quotas a little further. Agents equipped with a mobile CRM optimized for the insurance sales process have more chances to serve potential clients and convert them into customers.

Training Apps

Onboarding new personnel takes a lot of time and resources, especially in such an intricate industry like insurance. Training apps featuring best practices and explaining the insurance company’s workflows to new employees may turn out very helpful. They can even include tests for monitoring freshmen’s success during the onboarding process.

Claims Adjuster Apps

Claims adjusters spend most of their working hours outside the office, so enterprise mobility is the perfect solution to empower them to be more productive and access resources wherever they are.

A claims adjuster app can be developed to fit adjusters’ exact needs, with features including:

- Information on claims

- Library of documents

- Communications with customers

- eSignature capture

Team Communications

Organizing communication flows between insurance agents and other employees can go a long way. A mobile app with built-in live chats and video calls can serve as a seamless link between all involved parties. Therefore deploying a communication-enabling mobile solution can give a huge competitive edge to an insurance company.

Broker Apps

Like claim adjusters, brokers know pretty well the struggles of working away from the office and the difficulties of accessing and capturing information. A broker app with sales support features can help brokers in many ways, but mainly by making it as easy as possible to access sales and marketing data, track leads and cross-sell across insurance services and providers.

3. Aggregators

This type of insurance app allows for aggregating various programs and policies offered by a range of service providers. While insurers certainly benefit from having their services listed on other platforms, customers have more tools to access insurance products. Incorporating advanced technologies like AI and ML enables providing more personalization and driving better customer experience.

If you decide to pursue the development of an aggregator app, you’ll have to consider API integration. It will allow you to seamlessly connect to the required insurance company’s data and show it in your application. There might be two options here — either using the insurer’s API or building your own one to implement integration.

Let’s see the core features that aggregator apps should have in order to provide users with a comprehensive and seamless experience for comparing, selecting, and managing insurance policies.

Policy Comparison

The core functionality of an insurance aggregator app is to offer tools to compare various policies from multiple providers. Users should be able to filter options based on criteria like premiums, coverage, and benefits.

This feature provides clear, side-by-side comparisons to simplify decision-making and ensure customers select the required policy that best suits their needs — whether it is health, travel, property, or other type of insurance.

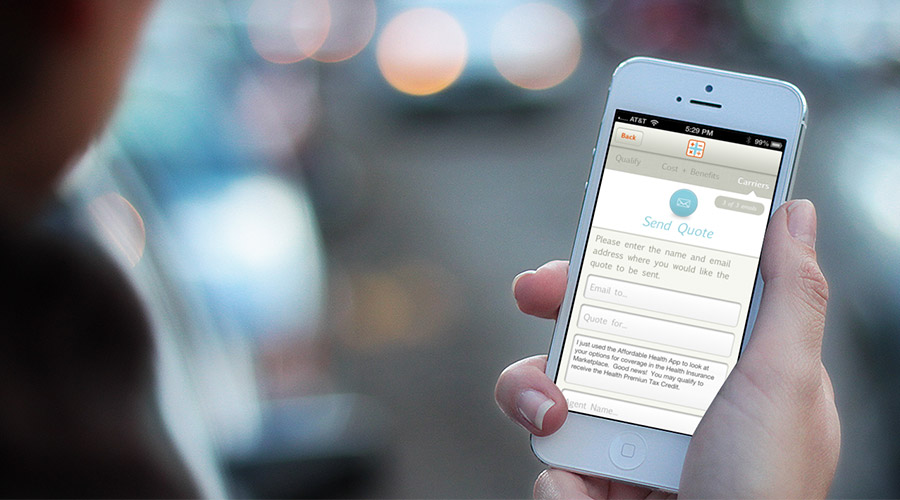

Quote Generation

Another useful feature is quote generation. After all, if an app provides users with policy comparisons, it’s natural to expect it to generate instant quotes as well. Based on user input, such as personal details, coverage requirements, and risk factors, built-in premium calculators help estimate costs, offering transparency and enabling quick evaluation of available insurance options.

Policy Purchase

Finally, the last essential feature here is to enable users to purchase or renew insurance policies directly within the app through secure payment gateways. Such functionality streamlines the process by issuing digital copies of policies instantly and eliminates the need for paperwork, providing convenience and efficiency.

Read more about the Integration of Mobile Payment Gateways

Apart from these key capabilities, insurance aggregators should allow users to manage their profiles, enable notifications and alerts, or even integrate AI-based features to suggest policies based on user preferences and history.

Advantages of Customer-Facing Insurance Mobile App Development

As you have seen in the previous section, there are several types of mobile apps for insurance.

First, we want to discuss the pros of client-facing ones. Here are the top five:

Convenience. Whether it’s to report claims from anywhere or manage other policy-related tasks, your customers will appreciate having all the necessary information and tools in one place. Similarly, you now have a practical way of getting all updates on client activity.

Speed. People don’t always want to reach out by phone or visit the insurer in person. Instead, they’ll value the opportunity to get a quick in-app consultation or interact with a chatbot to speed up their insurance search. In return, insurers get a fast way to interact with clients.

Personalization. Based on client data gathered, insurers can create highly customized offers and propose what the customer truly needs — a win-win situation for both sides.

Novelty. Apps themselves might not be new per se. After all, most of us use them every day. However, within the insurance industry, they aren’t common practice yet. By staying ahead of the curve, you will meet modern customer demands and be a pioneer in your sector.

Revenue. Thanks to the aforementioned benefits, customer satisfaction will increase and they will be coming to you for the best service. Of course, this will reflect positively on your bottom line.

Benefits of Employee-Facing Insurance Mobile App Development

Now that we’ve covered the benefits of customer-facing apps, let’s look over employee-focused ones.

Automation. Whether you choose a mobile CRM or a claim processing app, you’ll be giving your employees an invaluable tool. One that offers the opportunity to access all valuable work data from the palms of their hands. Talk of an efficiency uplift!

Simplified training. If you spend a lot of time onboarding new staff, an application might be precisely what you need. Centralizing all training materials in one place and even gamifying the training process can go a long way in improving your orientation processes.

Better team communication. Simplify internal communication among team members. Let them stay in touch through the application with the help of chats and other features that foster productive teamwork.

Key Functionalities for Your Future Mobile Insurance App

While covering the categories of insurance apps above, we’ve already mentioned some of the functionalities you might need to include in your solution. Of course, the set of features depends on what kind of application you are going to build.

Remember that you can always start with an MVP version without rushing into the development of an all-inclusive tool. An MVP allows you to validate your idea, test the solution, and get real feedback from users. After that, you can go further and develop a full-fledged product.

Find out How to Prioritize Features for an MVP App

Below, we provide the most common capabilities that the average insurance app usually has. Again, the list varies for insurance apps designed for employees or customers.

- User registration

- Claims processing

- Policy management

- In-app payments

- Push notifications

- Customer support

- Integrations with third-party tools

- Document management

- Analytics and reporting

- Security features

When You Shouldn’t Invest in Insurance Mobile Software

We’ve covered all the major benefits of app development, however, before you get started, you may want to ask yourself if you’re ready to invest in insurance solutions.

Keep reading to find out in which cases investing in mobile development might be a hasty idea.

You Have Outdated Legacy Systems

If this is the very beginning of your digital transformation journey and you want to dive headfirst into mobile app development — consider taking a pause. Do your existing systems meet current requirements? Is there something a tad more pressing for you to work on in terms of IT development?

If these questions made you pause and reconsider, then it’s best to look into legacy system modernization before setting your sights on mobile initiatives.

You’re Not Prepared to Commit

Developing an app is a complex process that requires a commitment to pay off. Sure, you may not build in-house and instead go for third-party custom development services. Yet, you have to realize that even the best external team will need to be in contact with you.

It’s essential to make sure they’re developing something that truly caters to your goals and business issues. Hence, evaluate your capabilities and determine if you can dedicate sufficient resources to the project before getting started with it.

You Don’t Have a Promotion Budget

Although the modern consumer is eager to interact with company reps through an app, people won’t immediately flock to download it. Younger customers and employees may join fast, but what about older clients and team members?

You’ll need to promote your new software and build awareness. All that requires resources. Have you already figured out what your PR and social media plan will be? If not, you really ought to account for these expenses before carrying on.

You Have Little Idea About How Much an Insurance Mobile App Will Cost

While you’ve probably done some research before setting out on the app development route, can you say you know how much this project will sum up to? Don’t get us wrong — it’s not that terrifying, but looking into how much apps cost to make is likely a good idea.

You Didn’t Account for the Increased Responsibility

In addition to your existing online presence, you will have an application that also tracks user activity. With that, comes a new responsibility to ensure privacy and abide by all the necessary regulations.

It may sound overwhelming, but you need to know what you’re getting into. Only after considering the above-mentioned points should you proceed with developing an app.

The good news is — you can always get professional help in crafting a wholesome IT strategy.

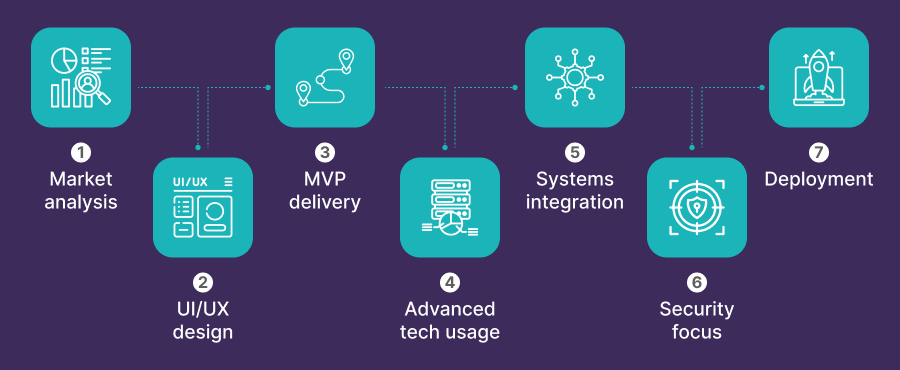

Insurance Mobile App Development: Key Steps to Follow

We’re not going to cover all the general steps of the development lifecycle as you most likely know them well — from analysis and UI/UX design to development, testing, and maintenance. However, let’s take a brief look at the essential steps that building an insurance app usually involves.

Read more about the Mobile App Development Process

1. Analyze the Market

Don’t underestimate the role of this step. Especially, if you’re creating an app for customers. Do research, consider competitors, what features their solutions have, and what you can offer to stand out and provide unique value.

The more knowledge you have about the target audience and the market, the easier it will be to elaborate on the requirements and come up with a successful solution. At this stage, you can also rely on the expertise of Business Analysts.

User-Driven Approach

Watch our webinar and learn the top ways of reducing poor user satisfaction, low adoption rates, and decreased loyalty.

On the other hand, if you plan to develop, let’s say, an app for your insurance agency to facilitate the daily activities of employees, then it’s also good to take a sneak peek at what other companies use. This way, you can note the best practices and avoid common mistakes.

2. Design Easy-to-Navigate UI/UX

While UI/UX design is one of the standard steps to take and we were not going to cover it, we think it’s still important to emphasize its role. Since usually, there’s a lot of data and numbers to display in insurance apps, users should feel comfortable navigating them.

No matter the app you create — for your insurance agency or an aggregator one, prioritize consistent look and feel with intuitive UI that will make it easy for users to address their needs and not the other way round.

3. Consider Building an MVP

In order to test and validate your idea, you can first start with building a prototype. After that, you can move on to delivering an MVP solution with a truncated functionality. In most cases, it allows companies to save costs and get a real-time picture of how their target audience interacts with an app. Collect feedback, improve the solution, and then provide a full-featured product to cater exactly to what users need.

4. Leverage Advanced Technologies

Think about whether your future app can benefit from the implementation of advanced technologies. The wide adoption of IoT, AI, Blockchain, and RPA tools creates new opportunities for app developers, including businesses that plan to build an insurance app.

If you’d like to dive deeper into the benefits of using certain technologies, below, we provide a list of blog posts where we highlighted their role and most common use cases for InsurTech.

- The power of Machine Learning in Insurance

- How Data Analytics Impacts the Insurance Industry

- Robotic Process Automation for Insurance Operations

- Advantages of Blockchain Insurance Apps

- Top Initiatives of Predictive Analytics in Insurance

5. Take into Account All Core Integrations

There’s no need to develop everything from scratch if you can use existing third-party tools and integrate your app with them. For example, consider integrations with maps for assistance with road accidents, electronic signature software for digital signing, and chat tools to enable customer support.

6. Focus on Security and Regulatory Compliance

Insurance businesses process a lot of sensitive data that they need to protect. That’s why app security is one of the most essential factors to keep in mind while building your insurance app.

Discuss with your app development team how you can ensure maximum safety — if they’re experienced in working with insurance software, they know the best practices and standards to follow.

Plus, consider your regional data protection regulations. For example, if you provide health insurance and process sensitive data, HIPAA will be a must to comply with. And GDPR is a set of rules to mind if you operate in Europe.

Discover more about HIPAA-Compliant App Development

7. Deploy, Monitor, and Enhance

If you want to provide value to users and make your insurance app successful in the long run, don’t think that the work is over once you’ve tested and deployed your solution. It goes beyond that.

Keep monitoring the app performance, quickly fix issues, and adjust features in accordance with users’ feedback and current trends. After all, you need to focus on user engagement and increase retention rates to stay competitive.

Find out 5 Ways to Drive App User Engagement and Retention

Mobile Development For Your Insurance Company

As we can see, there are plenty of use cases for mobile technologies to enhance customers’ user experience and empower employees.

Yet, despite the numerous benefits, there are also a few things to consider before starting the development journey. Not all businesses should immediately enter the world of mobile, especially when there are other things to tend to.

If you feel that your insurance company would benefit from a bespoke app or needs help with preparing a strategy — our team is happy to help!

Velvetech has over 10-year expertise in custom insurance software development and has worked on several insurance applications that are being tested in the field. Get in touch if you’re planning to deploy a mobile insurance solution.